Investor Insights

SHARE

Non-bank business lending and household spending

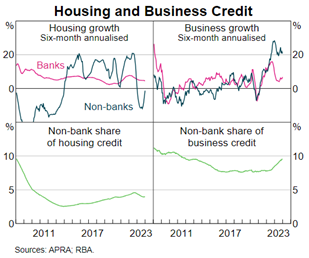

Recent data from the Reserve Bank of Australia (RBA) on the Australian non-bank financing sector alluded to the fact that businesses are continuing to turn to non-bank providers for funding. As evidenced in the graph below, the non-bank share of business credit is trending upwards. Businesses are actively turning to non-bank lenders for bespoke lending solutions and quicker access to capital, in order to maintain momentum and assist with achieving growth. The banking sector continues to be the dominant lender within the residential mortgage-backed securities (RMBS) market, as the capital requirements enforced by the regulatory framework have favoured this style of lending for the banks.

It is important to note that the Aura Private Credit team are aligned with our lenders in the sense that we are conservative when assessing and lending capital. Our lenders have not compromised their lending quality and underwriting standards to achieve their growth over time. This is what we believe sets our lenders apart from the large pool of non-bank lenders. Having screened over 90 lenders within the market and having funded eight over the life of the strategy. Our investment team spends a significant amount of time assessing and monitoring the full breadth of non-bank lending businesses.

Turning to the recently released economic indicators, households are continuing to feel the pressure and household spending is slowing. The 2.1 per cent annual growth in household spending was lower in March compared to the annual growth of 3.2 per cent in January and 4.0 per cent in February. The cost-of-living pressure is evident in the data. Households’ spending on goods, largely discretionary items such as food, has grown. Non-discretionary spending on the other hand is stalling, as households pull right back on nonessential goods and services. Spending on services slowed to 1.8 per cent in March, which is the lowest growth rate recorded since February 2021.

Further to this, retail turnover fell by 0.4 per cent in March 2024. Retail turnover has been relatively flat for the past six months, and the trend is highlighting a shift away from non-discretionary spending. The rising cost of discretionary items, education, healthcare, housing and insurance are putting significant pressure on households’ budgets and their spending habits.

It is clear in the data that households are feeling the pressure and altering their spending habits as a result. The market generally appears to be cautious and sceptical of the economic outlook. The RBA will be meeting this week.