Investor Insights

By , Polen Capital

SHARE

Investing in the age of transformation

Over the past two years, the evolution of the pandemic has been the leading force dictating the path of the global recovery. Despite the many challenges still present, Polen Capital believe that several secular trends that were already in motion before COVID-19 will continue to shape the world around us and play an important role in defining tomorrow’s leading businesses. In this whitepaper, Polen Capital look at what they view as some of the most important secular growth themes that may reshape the world over the next decade.

As long-term equity investors, Polen Capital believe that identifying these transformational trends – and the companies harnessing their power – is critical to generating sustainable positive equity market returns. This means looking at a horizon of years instead of just focusing on what could happen over the next week, month, or quarter.

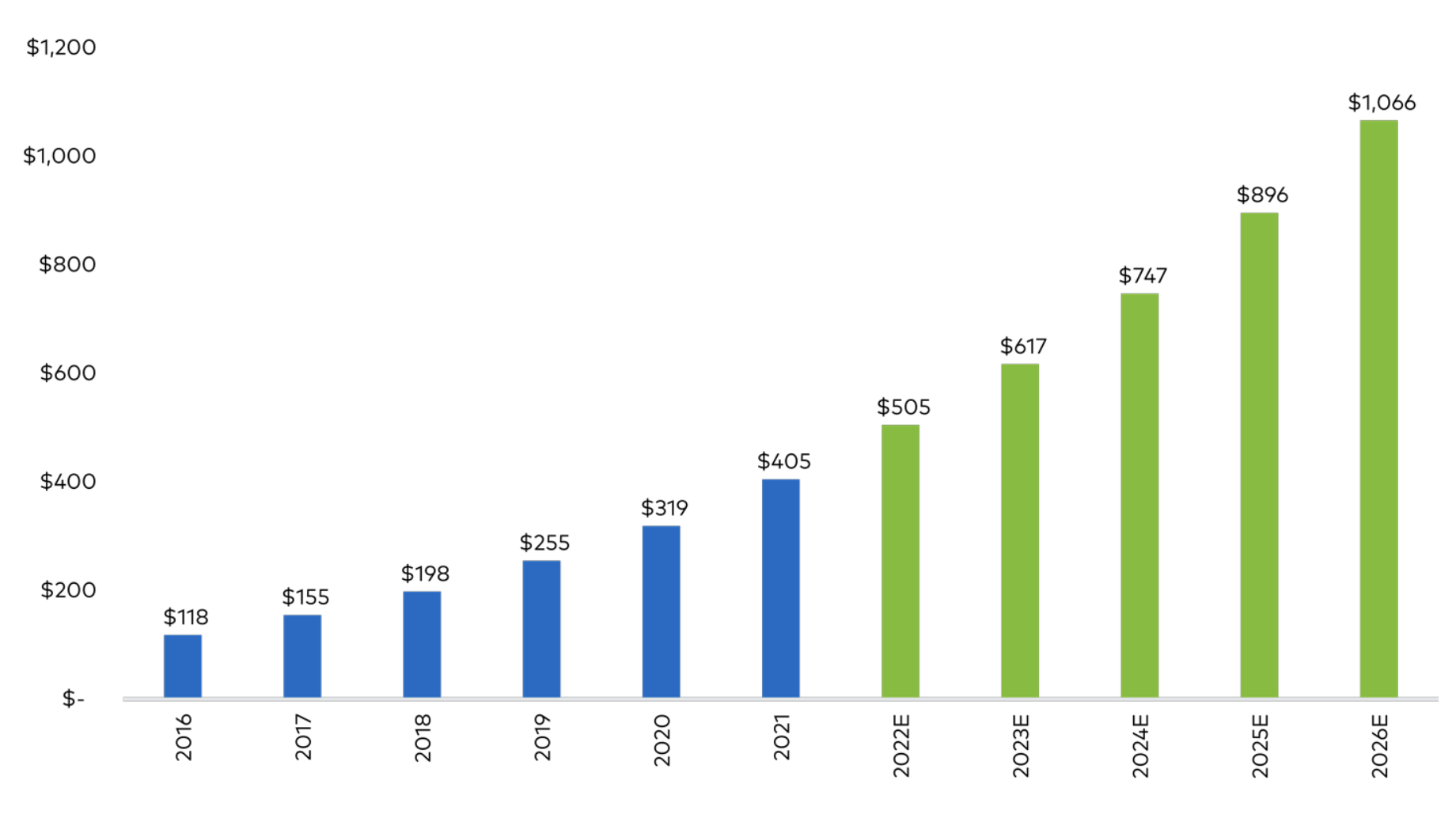

This paper aims to look beyond the short term and shed light on some of the megatrends Polen Capital think could define global economies and markets over the next decade. For example, we will look at the market for public cloud, which Bloomberg estimates may reach $1.1 trillion by 2026 in the U.S. alone.

Total Cloud Market Spending Forecast ($ Billions)

Source: IDC, Bloomberg Intelligence. As of May 2022