Investor Insights

29 Sep 2020

SHARE

What do low interest rates mean for equity markets?

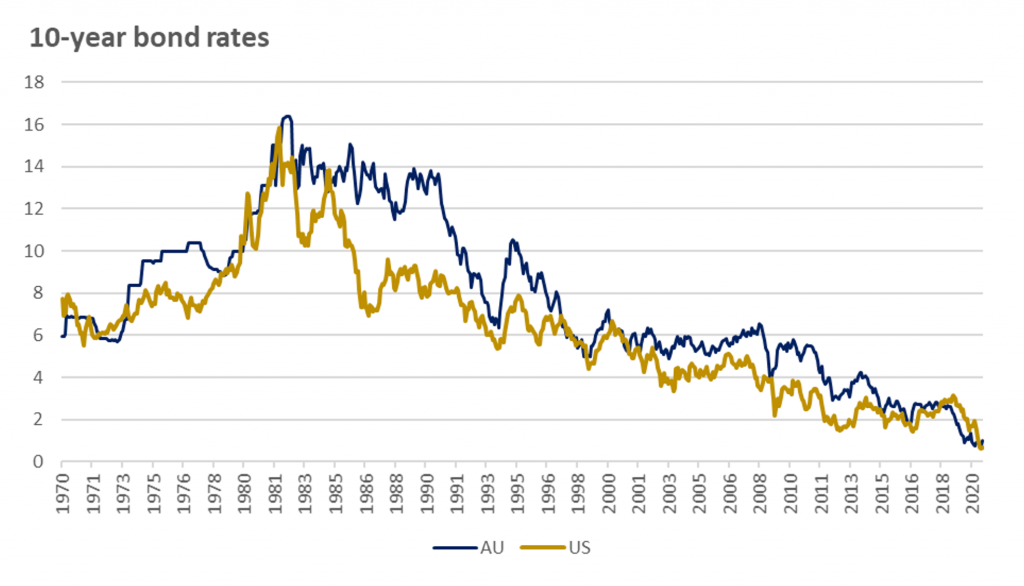

The last 30-40 years has seen a dramatic shift down in interest rates for much of the developed world. For example, the ten-year government bond yields in Australia and the US have declined from around 14 per cent in the early 80s to more recently lie somewhere not unadjacent to zero.

This relentless shift down in rates has naturally had profound implications for bond prices which are tied to rates by some straightforward math that requires the price of a bond to equal the coupon divided by the yield.

Exclusive Content

This is exclusive content to subscribers on rogermontgomery.com. View the full article via your subscription or sign up for access.