Investor Insights

SHARE

Is value investing poised to do well?

One of the most fundamental dichotomies that can be drawn in equity markets is the one that separates “value” from “growth”. In simple terms, you pick a basic metric – say price to earnings ratio – and you divide the market up into those stocks with a PE ratio above the average (growth stocks) and those with a PE ratio below the average (value stocks).

Mutually exclusive. Collectively exhaustive. Neat.

Investors may choose to prefer one category or the other based on their philosophy and beliefs. Normally, this equates to an assertion that the market, for one reason or another, tends to systematically overpay for the “other” type of stock, and so it is best avoided.

If we want to test this rationale, we should be able to learn something from the historical evidence; if the market does tend to overpay for one category or the other, that would show up in long-run return differences.

However, as you might expect, the historical evidence doesn’t offer a particularly compelling case either way. If it did, all investors would presumably choose the more desirable category and it would soon become expensive, erasing its future appeal.

What the evidence does suggest is that:

- Over very long stretches of time, value stocks have tended to do a little better than growth stocks – there is a good body of academic evidence to support this; but

- Since 2007, growth stocks have performed significantly better, and this trend accelerated in 2017 and then accelerated again in 2020.

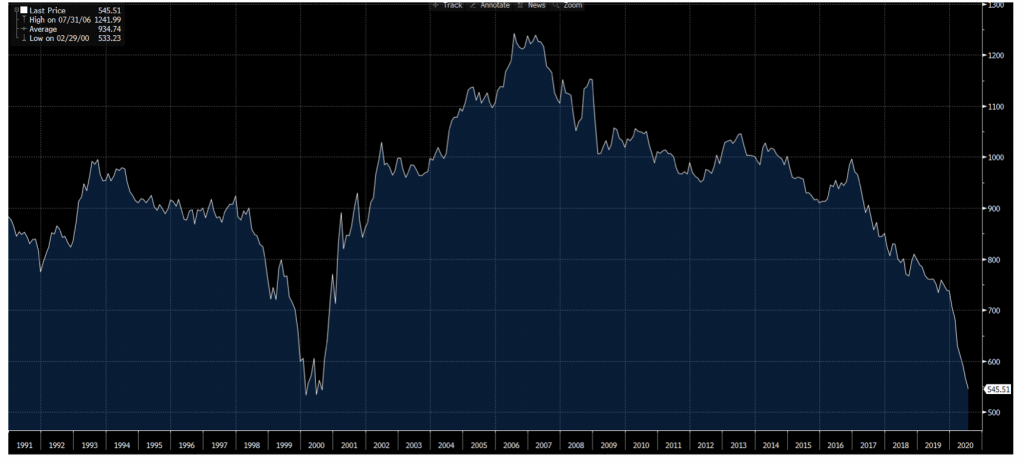

These more “recent” dynamics can be seen in the performance of the Russell 1000 Value/Growth Total Return Index, plotted below. You can see the impact of the tech boom in 2000 when value fell badly out of favour, followed by several years of strong value outperformance in the aftermath, and then the more recent run of 13-odd years of pain for value, transitioning into something approaching freefall in 2020.

Russell 1000 Value/Growth Total Return Index

Source: Bloomberg

This stretch of underperformance by value has been crushing for value-oriented managers. Today it is very hard to find a value manager with good ten-year numbers against broad market benchmarks, and the shorter-term numbers look particularly bad. Meanwhile, managers with a strong tilt towards growth fill out the top positions in the league tables.

The wide performance differential between the styles over the last ten years raises an important question for investors who would aspire to good returns over the next ten years – does the winning strategy (growth) of the last decade continue its run of outstanding success, or does value enjoy its turn in the relative sunshine.

Returning to our earlier logic, it is very hard to believe that in the future, growth will always prevail over value. This would imply that it is easy to divide the market down the middle and label one half “good” and the other half “bad”.

Even people who soundly reject the efficient markets hypothesis would accept that the market deserves a bit more credit than that.

More specifically, if one style could be shown to be consistently better than the other, then investors would flock to that style until it became unduly expensive, risky and vulnerable to a painful mean reversion.

Or, after 13 years, is that what has just happened?