Investor Insights

SHARE

The Polen Capital Global Small and Mid Cap Fund is now available via Netwealth

We are pleased to announce that the Polen Capital Global Small and Mid Cap Fund has been recently added to both the Netwealth Super/Pension and Investments (IDPS) menus. This is the second of Polen Capital’s global strategies that has been made available to investors via Netwealth, the first being the Polen Capital Global Growth Fund (B Class Units).

The Polen Capital Global Small and Mid Cap Fund is a long only, small and mid cap global equities strategy. The Fund typically invests in a concentrated portfolio of 25-35 high-quality companies within the global small and mid cap company universe. Relative to its mega cap counterparts, with the weighted average market capitalisation of around US$8 billion the Fund seeks to offer a concentrated portfolio of interesting fast-growing smaller companies with a huge potential global runway of growth ahead of them.

Just to show market timing is an incredibly difficult task even for professional managers, we brought these two Polen Capital global strategies to Australian investors in 2021. The following year was the worst year of performance Polen Capital had produced on an absolute and relative basis in both their U.S. Focus Growth flagship strategy since its inception in 1979, and their Global Growth strategy since its inception in 2015. In fact, we launched the Polen Capital Global Small and Mid Cap Fund in October 2021, which happened to be the last peak for the MSCI ACWI SMID Index, a level to which it is still yet to recover.

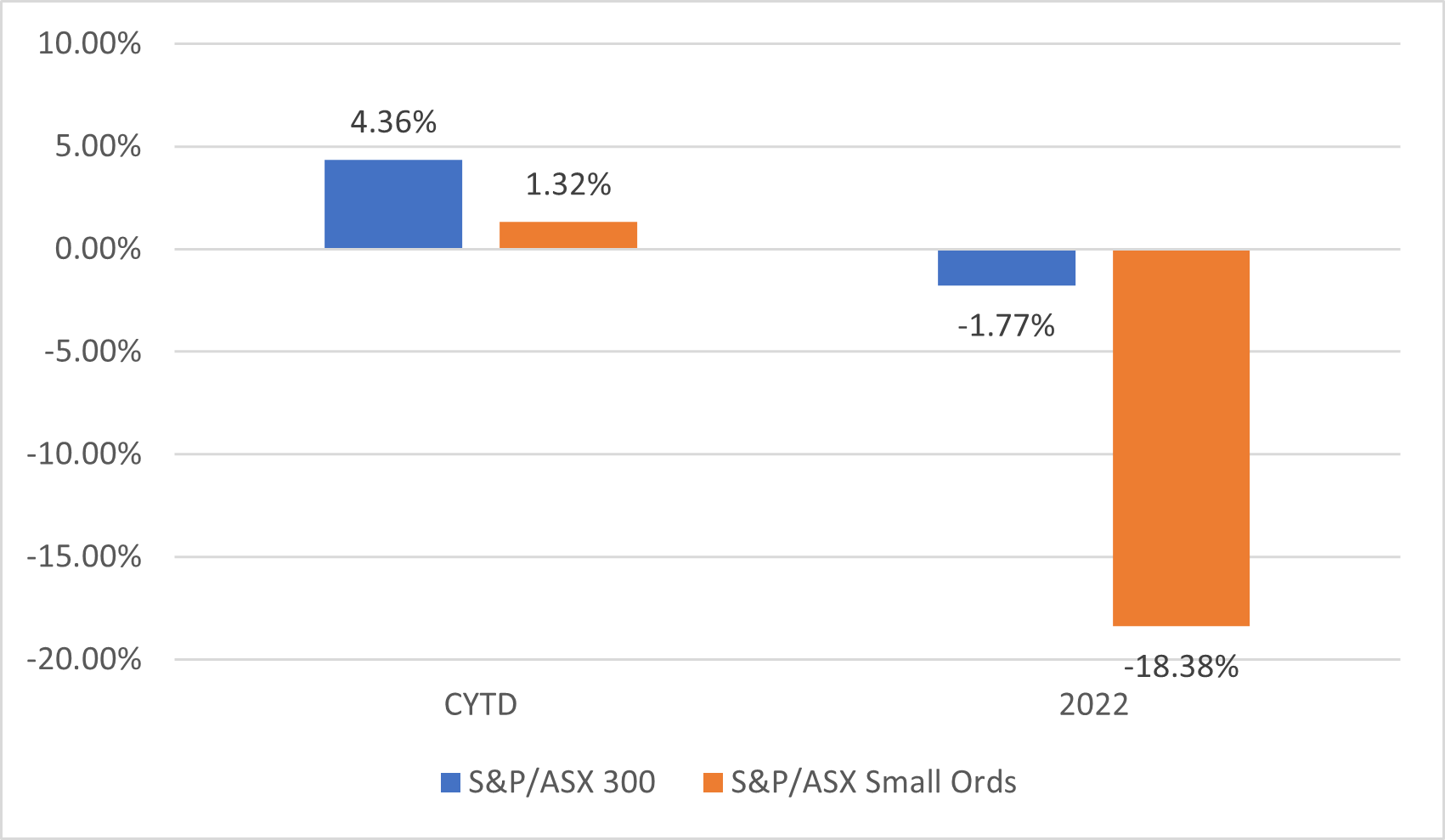

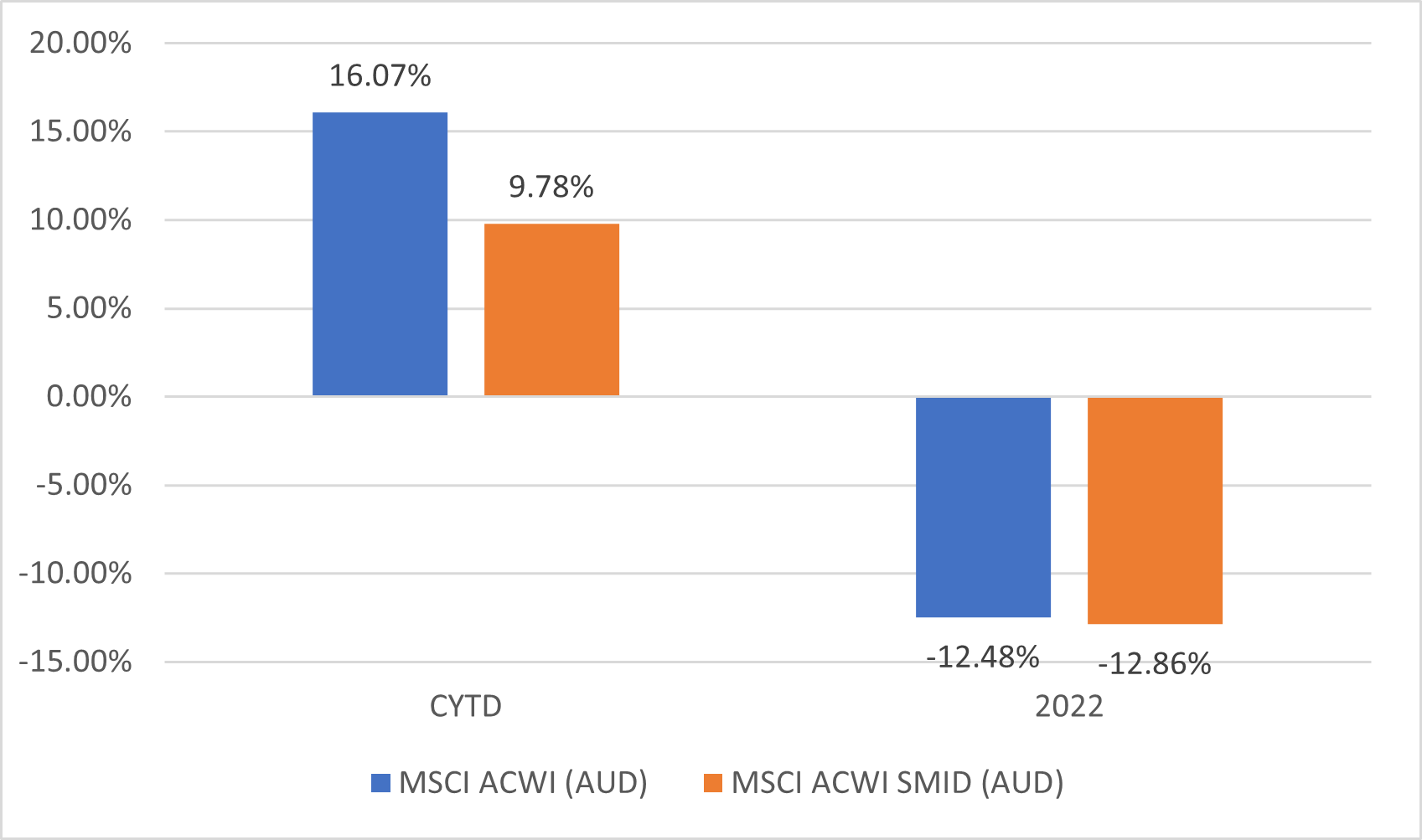

Indeed, small caps has been a dirty word for equity investors over the last 18 months. Whilst many would expect this in the “risk off” environment we had in 2022, what also has been surprising is that, overall, smalls cap prices have begun to recover from 2022 but are still lagging their large cap peers for the calendar year to date. This is true both in Australian and world markets, as illustrated in Charts 1 and 2 respectively below, which show performance for the calendar year to date (CYTD) and for the 2022 calendar year in Australian and world markets, comparing:

- the S&P/ASX 300 with the S&P/ASX Small Ordinaries indexes in the Australian market (Chart 1), and;

- the MSCI All Countries World Index (AUD) with the MSCI All Countries World Index SMID Index (AUD) indexes in global markets (Chart 2).

Chart 1: Aussie Bigs vs Smalls (as at 30 June 2023)

Source: Montgomery

Chart 2: World Bigs vs Smalls (as at 30 June 2023)

Source: Montgomery

It will be interesting to see whether the remainder of the 2023 calendar year will deliver good news for small cap stocks vis-à-vis large cap stocks, and for the portfolio of the Polen Capital Global Small and Mid Cap Fund.

If you would like to learn more about investing your super through Netwealth, you can do so here: Invest your personal super via Netwealth.

NOTE: This content was prepared by Montgomery Investment Management Pty Ltd (ABN 73 139 161 701) (AFSL No: 354564) (‘Montgomery’), the investment manager of the Polen Capital Global Small and Mid Cap Fund (ARSN: 652 035 642) (Fund). Fundhost Limited (ABN 69 092 517 087) (AFSL No: 233 045) (‘Fundhost’) is the Fund’s responsible entity and issues the units in the Fund. Montgomery has appointed Polen Capital Management, LLC (Authorised Rep No. 001285252) as the sub-investment manager.

This content has been prepared for the purpose of providing general information, without taking into account your particular objectives, financial circumstances or needs. You should obtain and consider a copy of the Product Disclosure Document (‘PDS’) relating to the Fund before making a decision to invest. The PDS and Target Market Determination (‘TMD’) are available here: https://www.montinvest.com/our-funds/polen-capital-global-small-and-mid-cap-fund/and here: https://fundhost.com.au/

While this content has been prepared with all reasonable care, no representation or warranty is made as to the accuracy or completeness of any statement within it, including any forecasts. Neither Fundhost nor Montgomery guarantees the performance of the Fund or the repayment of any investor’s capital. To the extent permitted by law, neither Montgomery nor its employees, consultants, advisers, officers or authorised representatives, are liable for any loss or damage arising as a result of reliance placed on this content. Past performance is not indicative of future performance.