Investor Insights

SHARE

Monetary policy meeting minutes

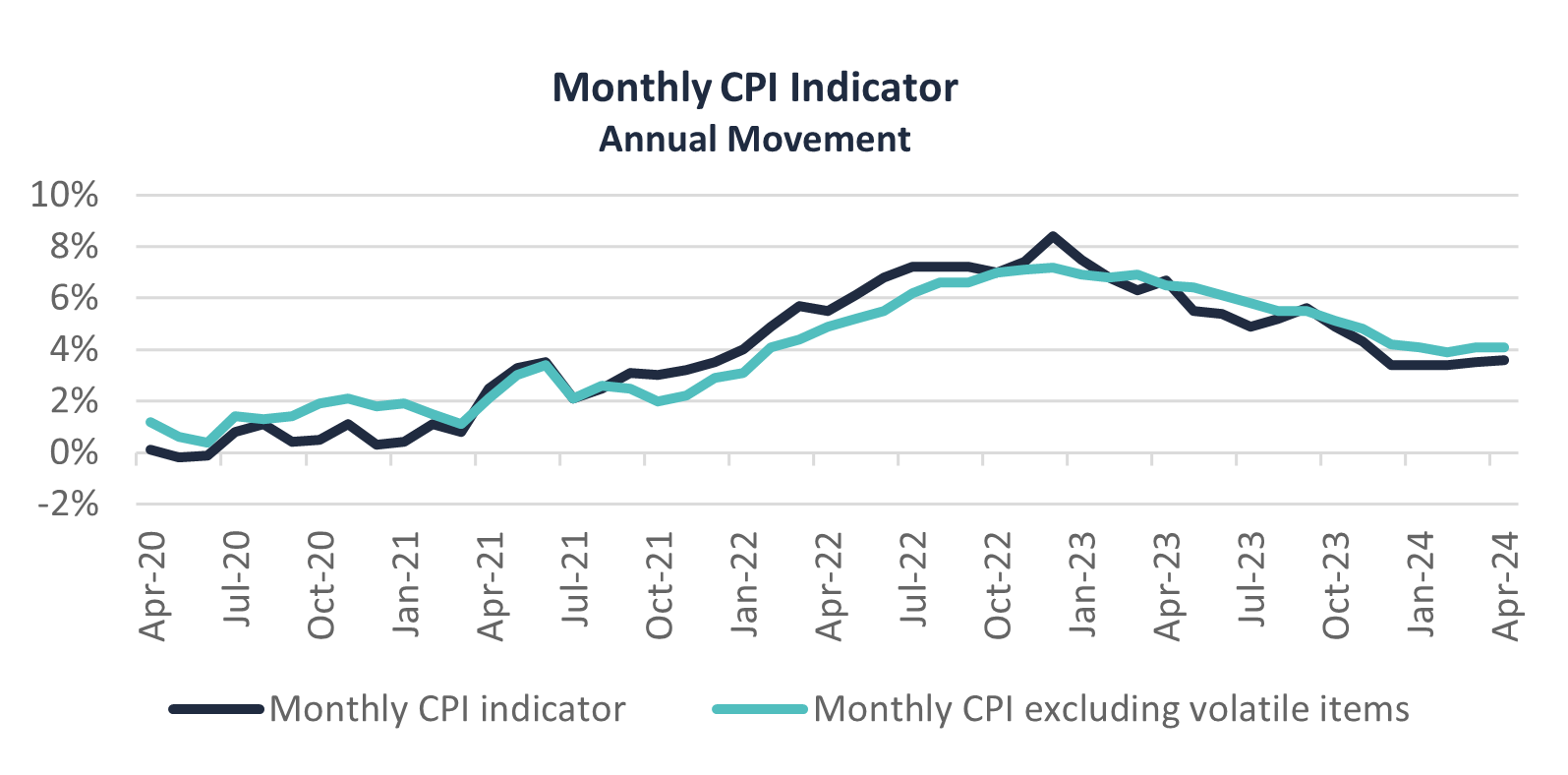

The monthly consumer price index (CPI) indicator released last week reported a 3.6 per cent increase in the 12 months to April. This follows the 3.5 per cent increase reported in March. We have seen relative stability in the rate of inflation since December 2023, albeit with slight upticks reported in the past two months. This data will be a key point for discussion at the Reserve Bank of Australia’s (RBA’s) next meeting on the 17th of June.

There are ongoing pricing pressures as businesses look to pass on the rising cost of operations onto the end consumer, along with unforeseen circumstances disrupting the balance between supply and demand, resulting in pricing increases. The April inflationary data was predominantly affected by the following:

- Elevated insurance prices with health insurance premium increases effective from 1 April.

- Unforeseen poor weather conditions are causing the largest annual increase in the price of fruit and vegetables since April 2023.

- Tight rental market and low vacancy rates across the country driving rental costs up.

- New housing prices inflated by 4.9 per cent as builders pass on the increases in labour and material costs to their consumers.

- Electricity prices rose by 4.2 per cent. The National Energy Bill Relief fund rebates offered from July 2023 had mostly offset the electricity prices. Without the rebates, the electricity prices would have risen by 13.9 per cent in the 12 months to April 2024.

If we exclude the volatile items, the monthly CPI indicator is higher at 4.1 per cent. The items impacting the volatility in prices include petrol, fruit and vegetables and holiday travel.

From a consumer standpoint, retail turnover was weak, with a 0.1 per cent increase in retail turnover reported for April. Retail spending has been flat since the beginning of this year as consumers remain cautious and pull back on their discretionary spending. With consumers already pulling back on spending and with the RBA’s main lever to hike interest rates and curb consumer spending, this may not be the only solution to bring inflation back within target. The concern at this stage is that inflation remains too high for too long, and as a result, inflation expectations are revised upwards causing longer term effects on wage prices and affordability. The RBA is facing the tradeoff between keeping rates on hold and acknowledging that consumers and households are evidently feeling the pinch versus actioning further intervention with the aim of ensuring the next inflation read shows more convincing evidence that it is heading in the right direction.