Investor Insights

SHARE

Household spending increases

The monthly household spending indicator released by the Australian Bureau of Statistics (ABS) last week, is an additional data point crucial to the Reserve Bank of Australia’s (RBA’s) ongoing monitoring and decision making. Household spending was 3.6 per cent higher than this time last year. This follows a slight dip we saw in December 2023. The ABS reported a 1.2 per cent increase in December 2023 and 2.9 per cent increase in January 2024.

The recent uptick is predominantly a result of increased spending in transport and automotive fuel. According to the monthly consumer price index (CPI) indicator, which we reported on last week, transport spending rose by 12.3 per cent and petrol prices rose by 4.1 per cent.

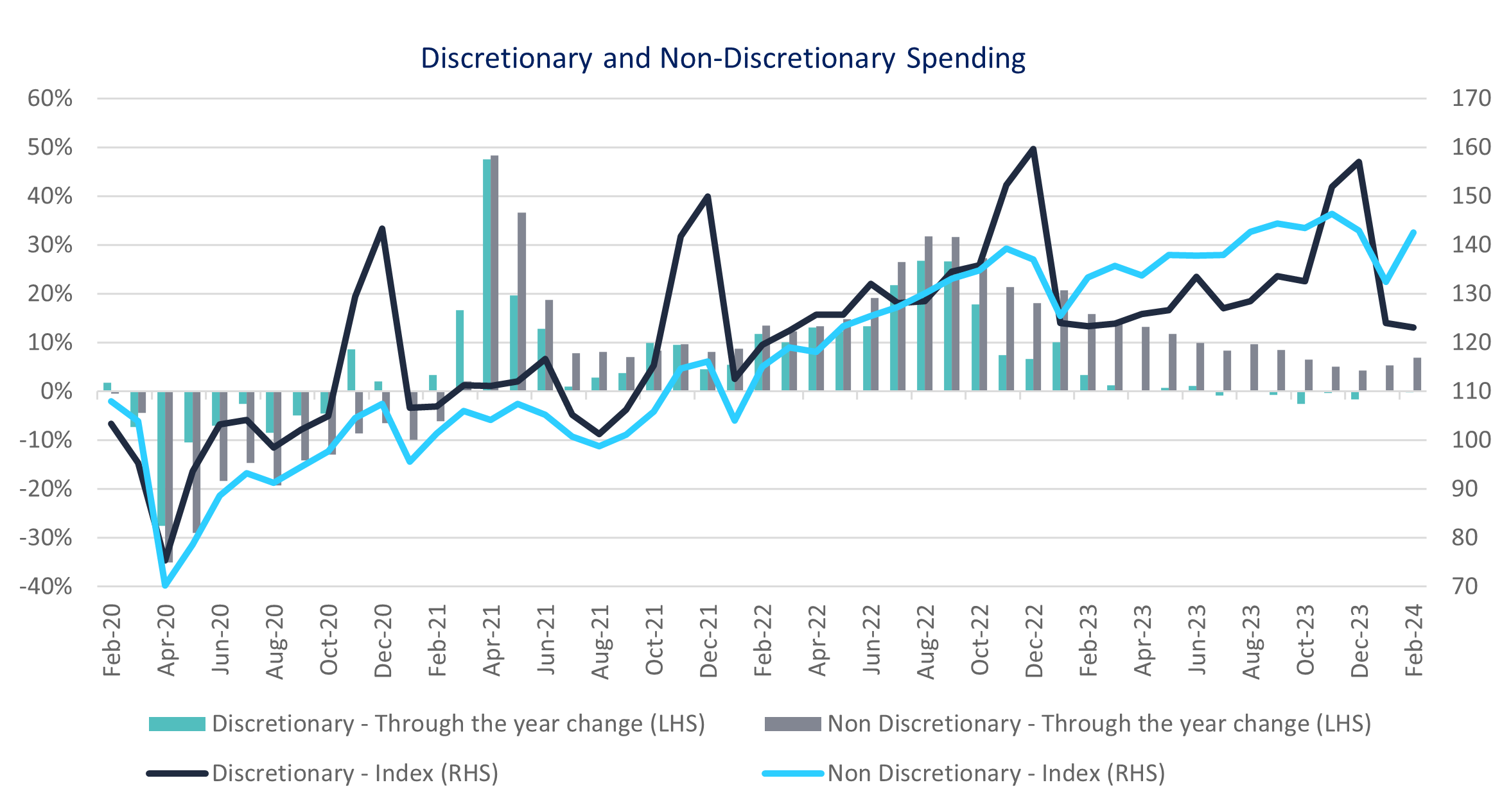

Signs of strain are evident within the data, as discretionary spending on goods and services fell by 0.2 per cent whilst non-discretionary spending rose by 6.9 per cent. The data points to a shift in consumer behaviour and spending as household budgets begin to feel the pinch.

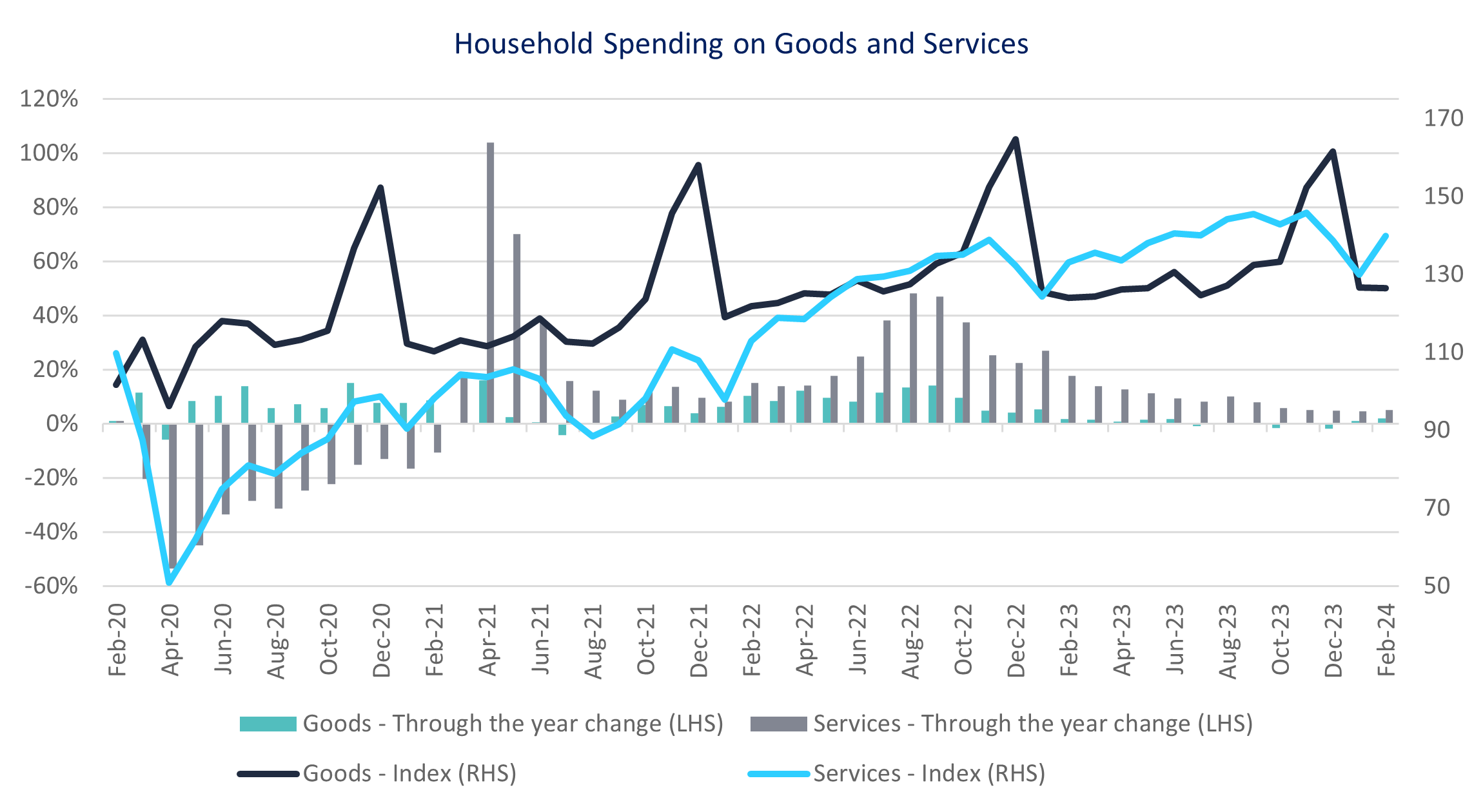

As we have previously flagged, the story is different when it comes to goods versus services inflation. Services inflation is proving persistent, and the data in the following graph illustrates that household spending on services has not tapered off in the same way as their spending on goods. Through the year up to February, household spending increased on services by 5.1 per cent and 1.9 per cent for goods. The increase in spending on services was led by transport and accommodation, whilst spending on goods was driven by food and goods for recreation and culture.

The rate of inflation and higher interest rate environment is weighing on households and their spending capacity and habits. With the ongoing pressure on affordability households are showing signs of pulling back on spending, particularly on discretionary items. This is a necessary evil, on the road to reducing inflation.

From a portfolio standpoint, our lenders recognise the ongoing pressures inflation and higher interest rates have on their underlying borrowers. As such, their credit assessment and screening processes are crucial in identifying and mitigating risks early on. At times such as this, security backing the loans is paramount, to ensure there is sufficient recourse to the borrower, should a loan go into default. As an investment team, we view the forward looking market conditions with a negative lens, to ensure we have measures in place to weather downside scenarios.