Investor Insights

SHARE

A $9 billion Opportunity for Non-bank SME Lenders

The conclusion of the Term Funding Facility and conclusion of the Federal Government Coronavirus SME Guarantee Scheme means approximately $9 billion1 of SME credit will require refinancing by Australian non-bank lenders over 2023 and 2024.

Recent Trends in SME Credit

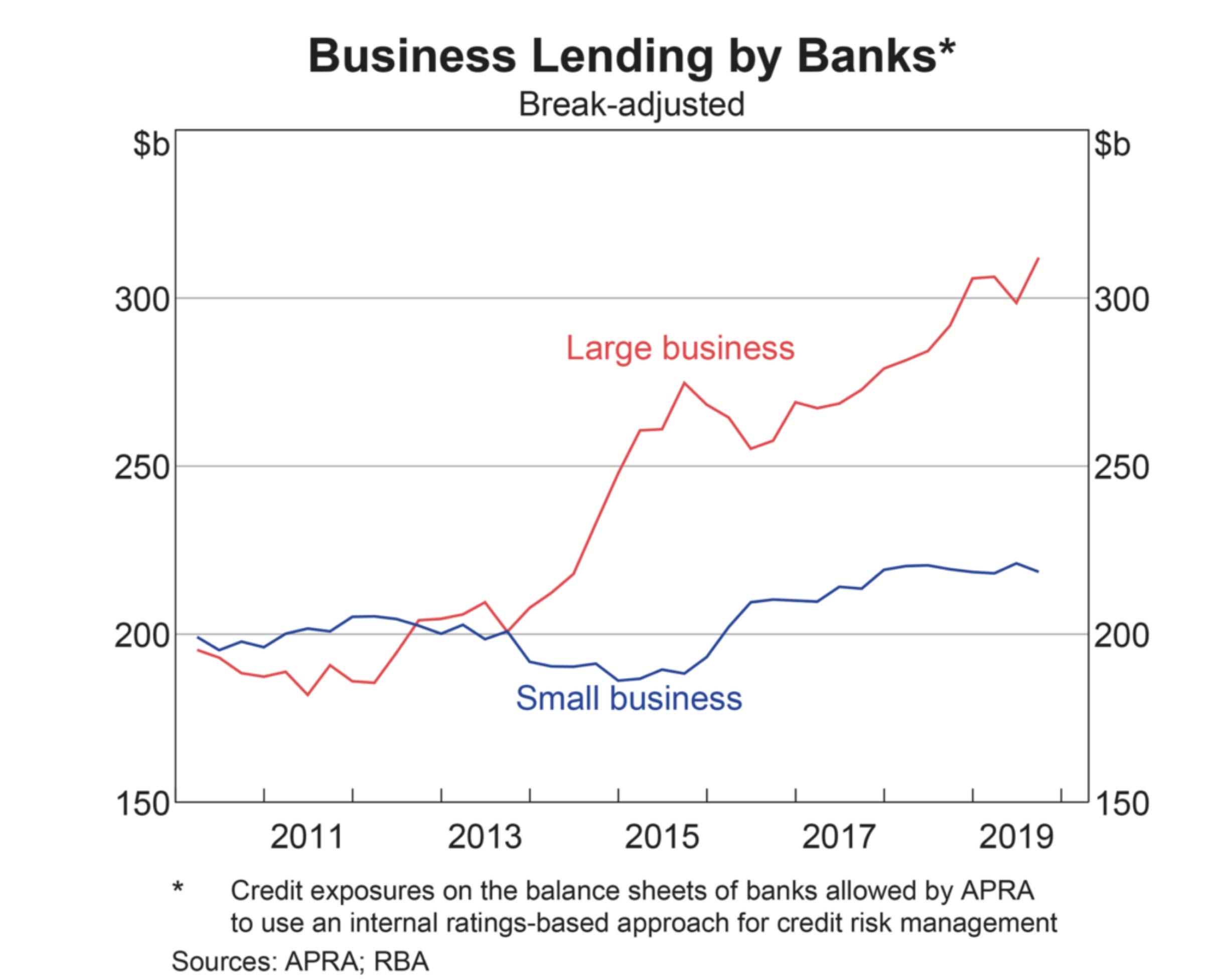

Commencing in 2014, growth in ADIs (typically referred to as ‘banks’) lending to SME businesses plateaued considerably. The majority of growth that occurred in business credit was allocated to large businesses.

In fact, the RBA’s September 2019 ‘Bank Lending to Business’ Data2 confirms a 31 per cent decline in SME (less than $2 million) credit approvals since June 2015. Meanwhile, banks shifted their lending to large business (more than $2 million) loans.

Interestingly, data from the Australian Banking Association3 suggests that this is not a result of preference by ADIs. According to data outlined in the association’s September 2019 Economic Report, there was “a 33 per cent decline in (SME) business loan approvals over the preceding five years, while approval rates remain around 94 per cent.”

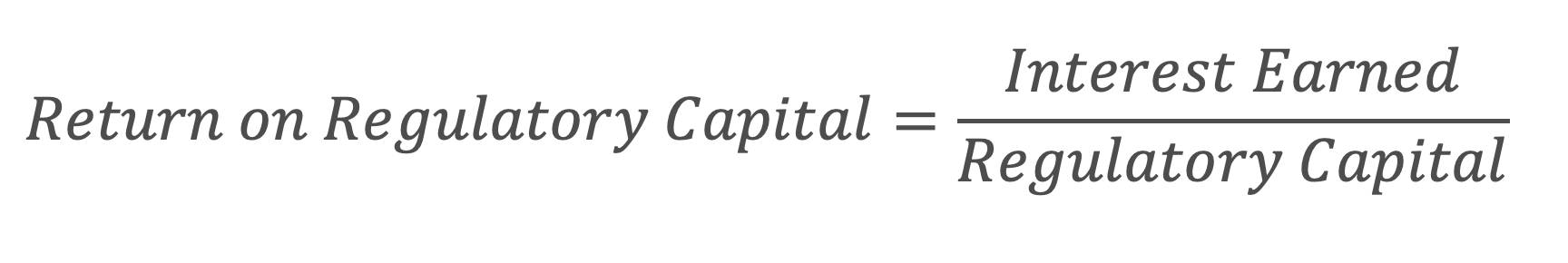

When writing loans, banks will focus on their Return on Regulatory Capital. Regulatory capital is capital that must be set aside for each loan and is measured as a percentage of the loan value. ADIs return on regulatory capital is calculated as:

For SME loans that are not secured by residential property, regulatory capital requirements for ADIs are relatively high, reducing the return on regulatory capital for the same level of interest earned.

Given the poor return on regulatory capital for non-property secured SME business loans, ADIs deprioritised efficiency and technological advancements for this loan type. Instead, they prioritised large business loans and residential property secured SME business loans. The resulting poor service delivered to SME business borrowers—who were not prepared to provide residential property as security—is the key driver of the plateau in growth of credit provided by ADIs to SME businesses.

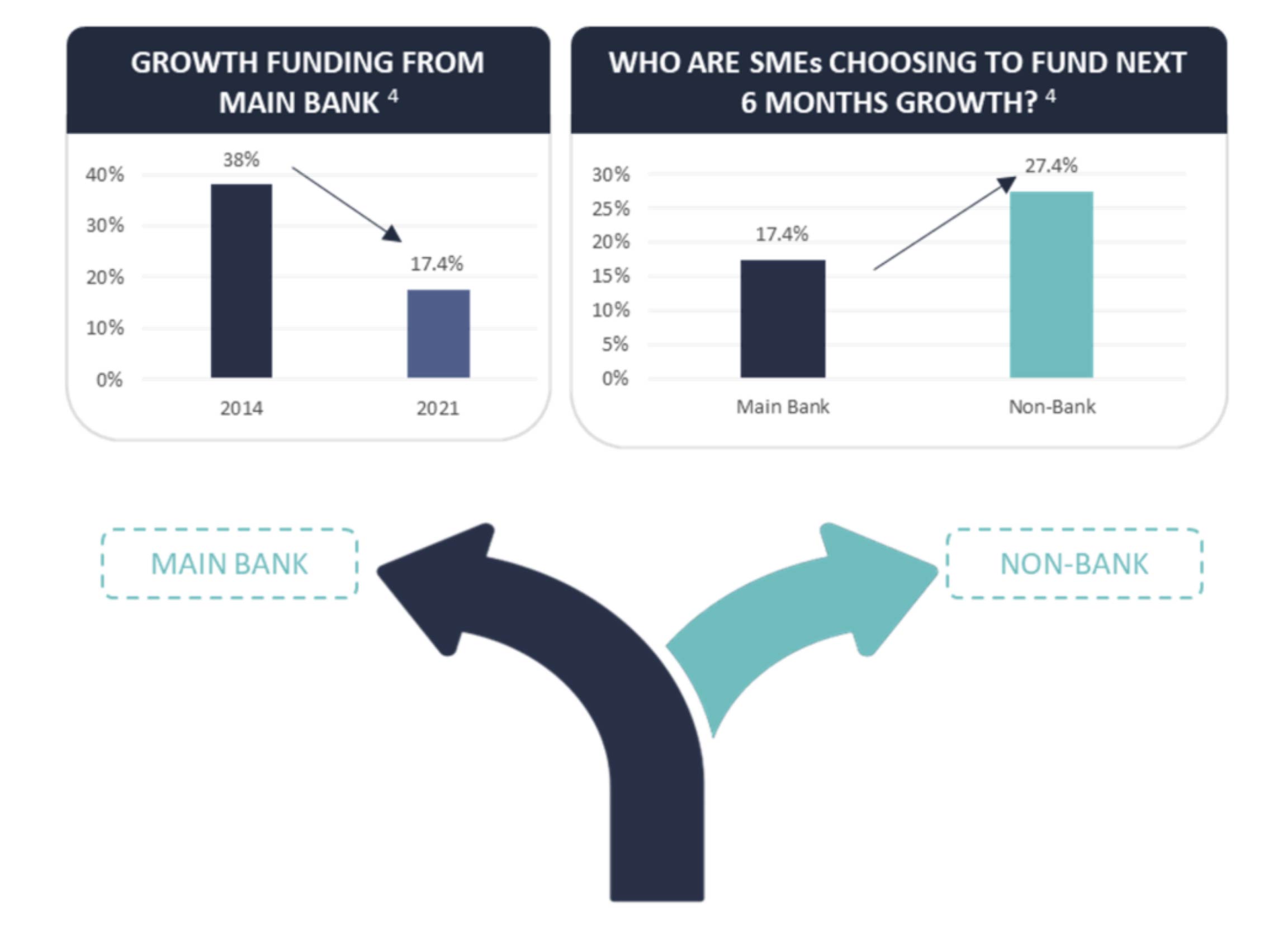

Picking up market share from the banks, the Australian Fintech/Non-bank lending sector has progressed by leaps and bounds in terms of technological implementation, underwriting efficiency and overall service provided to SME business borrowers. Reinforcing this thesis, the Australian Institute of Credit Management found that “one in 12 SMEs has already added non-bank funding facilities” and “a further 1 in 8 small businesses planned to add non-bank funding facilities to cope with their cash flow needs in 2021.” 4

Government COVID-19 Pandemic Response: Reversing the Trend

The COVID-19 pandemic, lockdowns and respective economic impact spurred the introduction of two primary policies focused on SME business credit:

- Term Funding Facility5

The Term Funding Facility was a key component of the central bank’s quantitative easing program, offering ADIs credit at a 0.1 per cent interest rate for a fixed 3-year term, funded via the creation of new money. - Federal Government Coronavirus SME Guarantee Scheme6

For eligible loans written under the scheme, the Government provided a 50 per cent guarantee.

The latter policy split the denominator of the regulatory capital equation. In other words, it halved the amount of regulatory capital that must be set aside for each loan, therefore doubling the return on regulatory capital for ADIs, all else being equal. This saw banks draw down on the Term Funding Facility and invest into circa 3-year SME business loans to the tune of $9 billion1.

Market Intervention Supporting the Big End of Town: The Devil is in the Detail

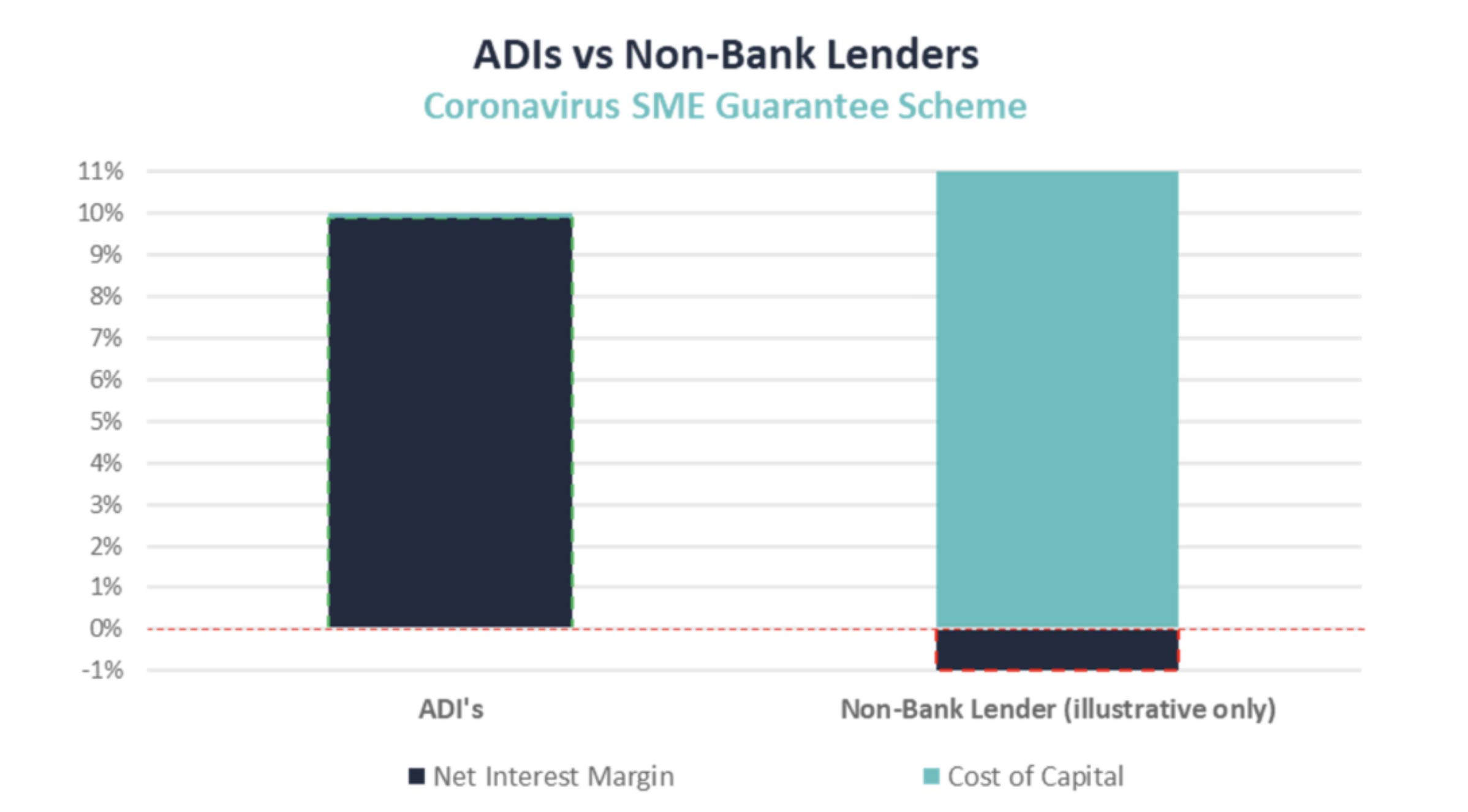

A key eligibility criterion of the SME Guarantee Scheme was that loans could not have an interest rate in excess of 10 per cent6. While this was not an issue for banks, borrowing at a 0.1 per cent interest rate (making a 9.9 per cent net interest margin) it was an issue for Fintech/non-bank lenders whose own cost of capital exceeded 10 per cent.

For example, the Aura High Yield SME Fund provides debt capital funding to fintech/non-bank lenders in order to fund their SME business loan books. Throughout calendar year 2020, the Aura High Yield SME Fund produced a distribution reinvestment return of 9.26 per cetn* net of all fees and expenses, with a gross return in excess of 10 per cent*, i.e., what it charges fintech/non-bank lenders on the capital provided. Writing loans under the Coronavirus SME Guarantee Scheme was therefore an uneconomical proposition for many fintech/non-bank lenders as they would produce a negative net interest margin—that is, a loss—on said loans.

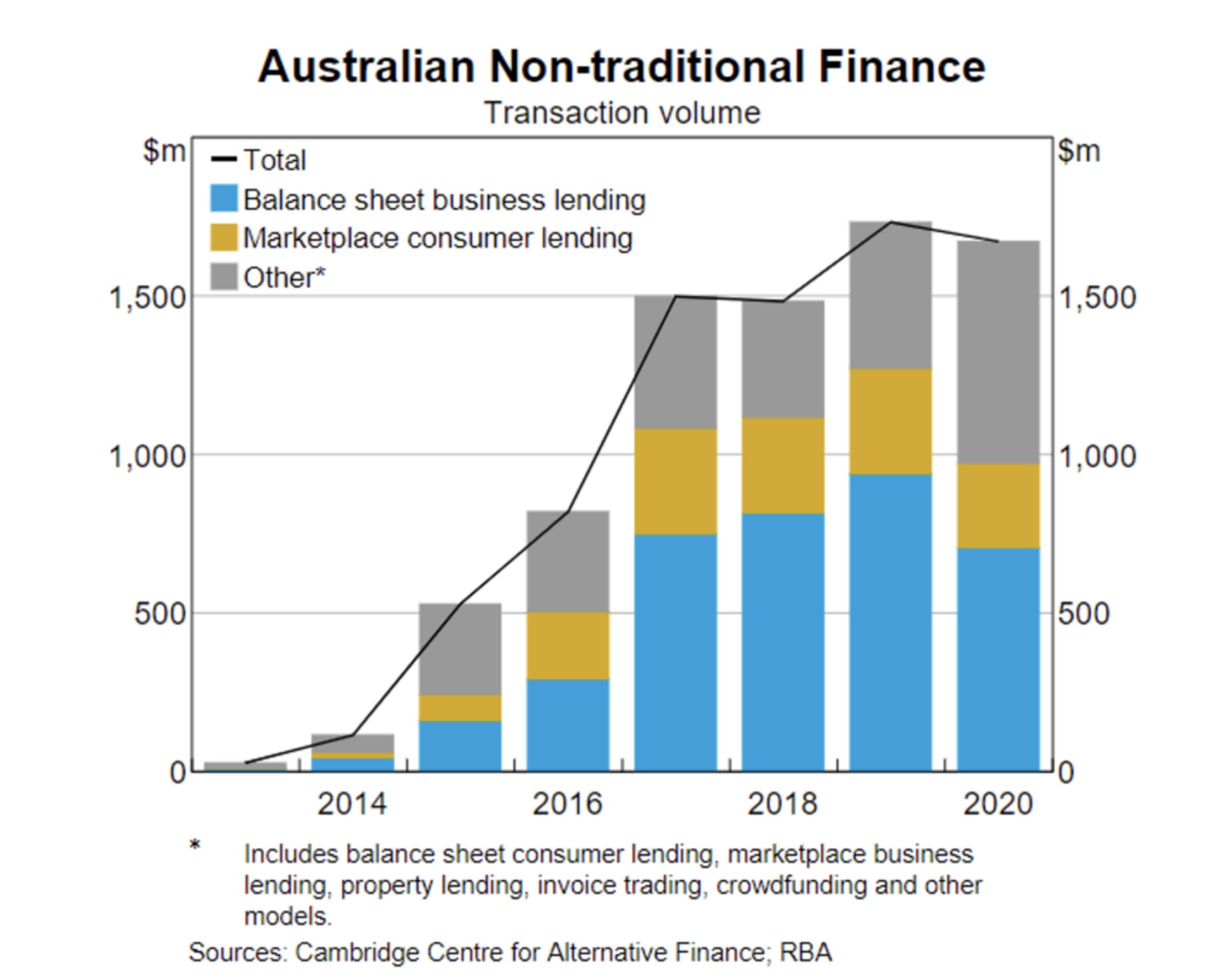

The impact on SME business lending volumes throughout the pandemic for fintech/non-bank lenders is displayed in the above graph.

Unwinding the Stimulus: Opportunity for Fintech Lenders

As at 30 June 2021, both the Term Funding Facility and the Coronavirus SME Guarantee Scheme were no longer offered to ADIs. As a result, it was no longer economical for ADIs to continue writing non-property secured SME business loans.

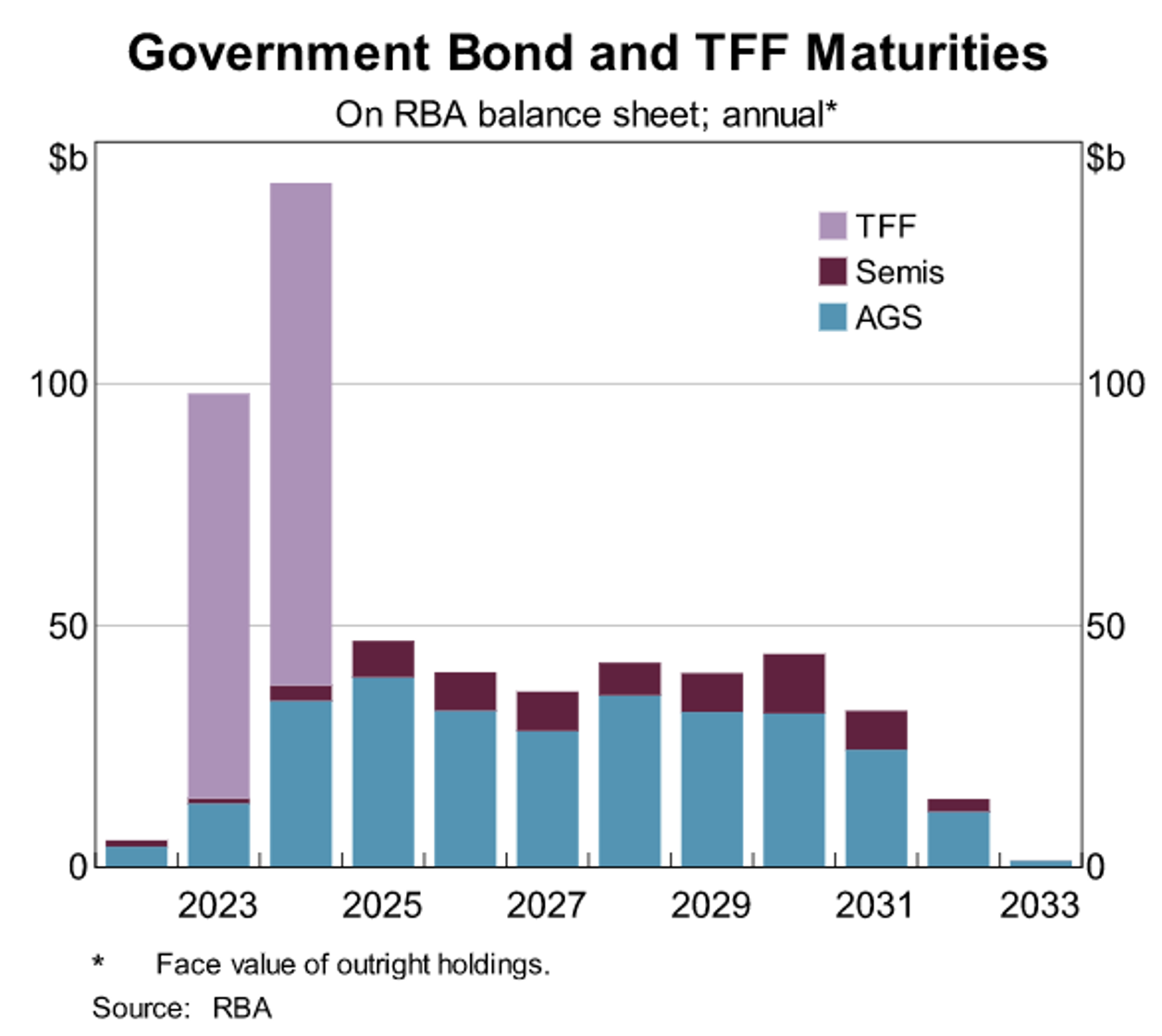

The Reserve Bank of Australia has since announced that it will conduct Quantitative Tightening. Through quantitative tightening, capital lent to ADIs (TFF), State Governments (Semis) and the Federal Government (AGS), via newly created money, will not be extended beyond the originally agreed maturity (as displayed in the graph above). This capital, including the Term Funding Facility, which matures over 2023 and 2024, must be repaid to the Central Bank and will then be destroyed.

ADIs were tactful with the loans they wrote, utilising the Term Funding Facility, aligning the 3-year maturity profiles so they may have the option not to refinance the loans and close out their position. This was most notable in 3-year fixed rate mortgages over 2020 and 2021. Raising additional capital to hold on to their mortgage exposures may prove sensible, however, doing so to maintain the $9 billion of non-property secured SME business loans will be uneconomical for ADIs.

This will create an additional $9 billion of quality investment opportunities for non-bank lenders over 2023 and 2024. Financiers like the Aura High Yield SME Fund, the Aura Core Income Fund, and the non-bank lenders they work with will have a greater ability to pick and choose high quality underlying SME borrowers.

To recap, the Aura High Yield SME Fund, designed for wholesale investors with a minimum initial investment of $100,000, delivered investors a net return of 8.31 per cent, assuming reinvestment of monthly income, over the calendar 2022 year. The Fund was recognised as:

- 2nd best performing Credit Hedge Fund in Australia and 3rd best across Asia-Pacific for H1 2020 by Preqin;

- 1st best performing Credit Hedge Fund in Australia and 2nd best across Asia-Pacific for H1 2022 by Preqin; and

- Best Fund in Asia for 2022 at the HFM Asian Performance Awards for the Fixed Income, High Yield & Distressed category.

The Fund was incepted in August 2017 and as at 31 December 2022 (most recent data point at the time of writing) has a perfect capital preservation track record, maintaining a $1 NAV at all monthly liquidity windows.

For retail investors with a minimum initial investment of $25,000, the Aura Core Income Fund was launched with Montgomery’s assistance on 4 October 2022, and has delivered a total net return of 1.51 per cent for the period to 31 December 2022, assuming reinvestment of monthly income, in its first three months of existence.

If you would like to learn more about the Aura Core Income Fund, please visit the fund’s web page to learn more: Aura Core Income Fund

If you would like to learn more about the Aura High Yield SME Fund (wholesale clients only), please visit the fund’s web page to learn more: Aura High Yield SME Fund

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

1RBA Research Discussion Paper – “The Term Funding Facility: Has it Encouraged Business Lending?” The Term Funding Facility: Has It Encouraged Business Lending? (rba.gov.au)

2RBA Statistics Discontinued Data – Bank Lending to Business – New Credit Approvals by Size and by Purpose

3Australian Banking Association Economic Report, September 2019

4Australian Institute of Credit Management – January 2021 Credit Management in Australia – January 2021 by AICM – Issuu

5 RBA Speech – “Responding to the Economic Impact of Covid” Responding to the Economic and Financial Impact of COVID-19 (rba.gov.au)

6Treasury – Coronavirus SME Guarantee Scheme Coronavirus SME Guarantee Scheme Phase 2 | Treasury.gov.au

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.