Investor Insights

SHARE

Where models fail

At Montaka we consider ourselves value investors. That is, we aim to buy a dollar of value for less than it is worth. Inherent in this approach is estimating the intrinsic value of an investment, and we use financial models to achieve this. It is worth examining the shortcomings of such an approach and instances where an over-reliance on a financial model can be deleterious.

Let’s start with the concept of intrinsic value. What does it mean? In a theoretical sense, the intrinsic value of a business is the present value of all future cash flows a business can be expected to generate over its life. Unless you are a math savant, it’s likely that you will require a spreadsheet to make estimates around this. It is from this that financial models are born.

Financials models can be incredibly useful in understanding key sensitivities and how the value of a business can react to changes in key assumptions. For example, you can look at different scenarios of revenue and profit growth, easily observing how these changes will alter the intrinsic value estimate. This allows analysts to estimate a valuation range, and then to assess whether the risk/reward at a given price is attractive or not.

George Box, the British statistician, has been quoted as saying “all models are wrong, but some are useful.” We would agree with this. A financial model is a relatively simplified abstraction of a complex reality, and even the best models are imperfect. We seek to avoid a blind adherence to the valuation outputs generated by financial models, and instead use them as a tool to understand what the value of a stock might be and what the key sensitivities are.

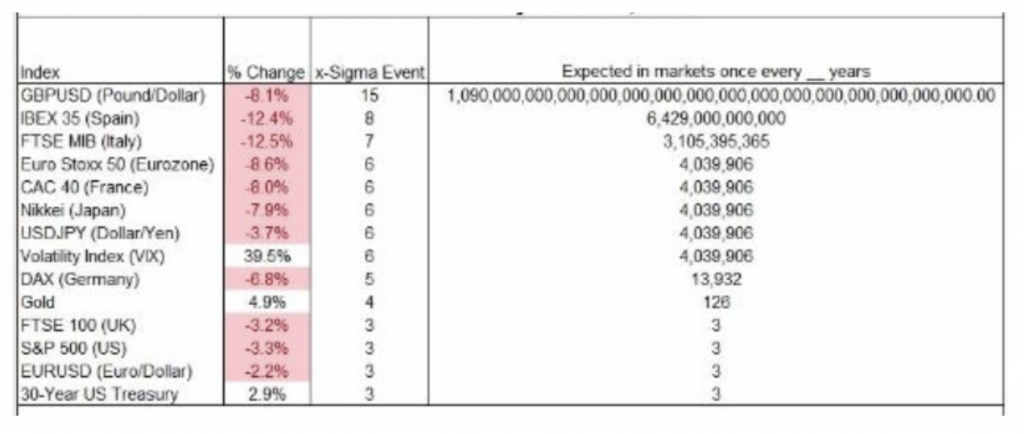

What the COVID-19 pandemic has illustrated is the danger in using financial models – which are informed and based on historical data and patterns – in trying to forecast the future. In recent history, we have seen a number of financial events that were 5+ standard deviations from the norm. Said another way, a 5-sigma event is expected to occur once every 13,923 years. While it might seem enormously improbable, these high sigma events do in fact occur, and at a frequency that’s much higher than what statistics would suggest (see the table below).

The problem with financial models is the inherent difficulty in capturing these sorts of events, given that valuation models are being driven by historical data. In the words of Nassim Taleb, “A model might show you some risks, but not the risks of using it. Moreover, models are built on a finite set of parameters, while reality affords us infinite sources of risks.”

When using financial models, we must be conscious of the fact that valuation estimates are based on data that is observable today and do a poor job of incorporating unforeseen events. For many companies in the cruise line, hotel, or airline industries, the bear case scenarios in analyst models would almost certainly have not included a pandemic scenario before we learned of COVID-19.

Financial models can be useful, but investors need to be mindful of their shortcomings and situations where too great a reliance on the numbers generated by a financial model can be catastrophic.