Investor Insights

SHARE

Why we like Ping An

Ping An Insurance Company is arguably the most successful insurance company in China and the largest insurer globally by market capitalization. Ping An is anchored by its industry-leading life and health insurance business (Ping An Life) and has an attractive satellite of other insurance, banking and fintech operations that combine to form a robust financial services ecosystem.

More important than being a great business, we believe Ping An is substantially undervalued as investors overly focus on recent investments and changes to the structure of its life insurance business, while missing the bigger structural and company-specific tailwinds that will drive future value creation.

Attractive industry tailwinds

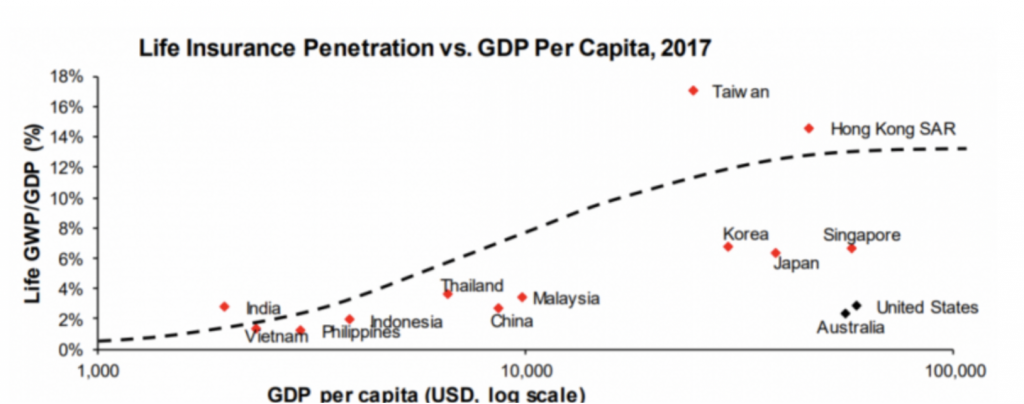

The Chinese life insurance sector is the second-largest life insurance market in the world behind the U.S. According to Swiss Re, life insurance gross written premiums (GWP) grew at 17 per cent compounded annual growth rate (CAGR) between 2013 and 2018 to nearly US$400 billion annually, and is poised to continue delivering strong growth as several industry tailwinds play out. Rising Chinese GDP per capita, a growing middle class and the lack of publicly funded social insurance (relative to Western countries) has pushed individuals to self-insurer through both life insurance and, increasingly, protection-oriented health insurance. According to Bernstein analysis, life insurance penetration in Asia accelerates meaningfully once GDP per capita reaches the US$10,000 inflection point. If China follows the same path as its north Asian neighbours, we could expect life GWP to more than double as a percentage of GDP over the next several decades.

Chart 1: Demand for life insurance accelerates after the US$10,000 GDP per capita inflection point

Source: IMF, Swiss Re Sigma, and Bernstein analysis

Interestingly, the life sector faced headwinds in 2018 and most of 2019 as Chinese regulators sought to clean up excessive sales of short-term wealth management products, which include single-premium and other short-term savings-oriented life insurance products. The headline impact was depressed life premium growth, but the shift towards long-term savings and protection products actually drives higher profitability and improves the insurers’ quality of earnings. Considering China is still in the relatively early stages of life insurance adoption, there is substantial runway for these higher profitability protection products to grow.

A strong life insurance business

Ping An Life, the crown jewel of the Ping An group, accounts for two-thirds of the group’s Operating Profit After Tax (OPAT) and helps drive a stable 22 per cent operating return on equity, double the group’s cost of equity. Ping An Life has delivered GWP growth of 22 per cent CAGR over the last 4 years and has grown OPAT at 30 per cent. Underpinning the strong premium growth is Ping An’s distribution network of 1.17 million well-trained insurance agents. Agent count actually declined 18 per cent in 2019 as Ping An restructured its insurance operations to emphasize protection products over short-term savings products, and also focused on agent training. Ping An now utilizes AI to recruit and provide ongoing training to its agent force, and the results are already telling – agent productivity increased 16 per cent in 2019 after lagging at only 2 per cent over the prior three years.

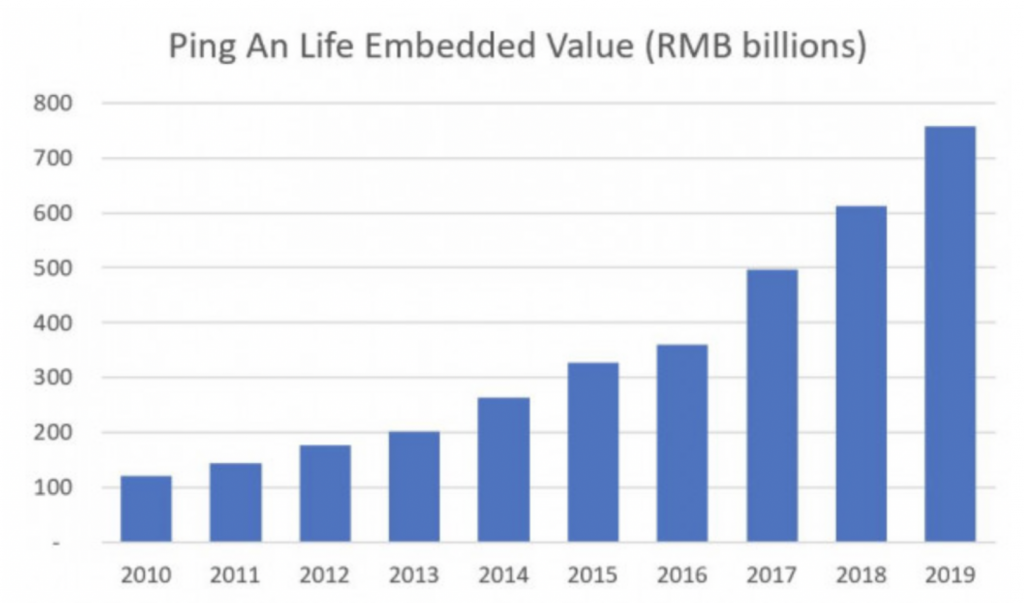

More important than annual premium and earnings growth is the Embedded Value (EV), or the present value of all future premium income less insurance expenses generated by the existing book of business. Due to the long-term nature of life insurance, future premiums and earnings are often “locked-in” when the contract is written, therefore the trajectory of EV is more demonstrative of the quality and current performance of a life insurance operation.

Chart 2: Ping An Life Embedded Value

Source: Company filings, Montaka analysis

For Ping An Life, EV has grown at 23 per cent CAGR over the last 10 years.This reflects the quality and profitability of the insurance business that Ping An’s agents are writing. A key measure of life insurance profitability known as the New Business Margin (NBM) has increased from 30 per cent in 2014 to 47 per cent in 2019. NBM is defined as the NPV of new business written in one year divided by the first year premium of that business. As such, a rising NBM indicates an insurer is writing longer-term protection contracts with higher profit, while a declining NBM indicates high volumes of short-term savings contracts that boost premium income but is not profitable for the insurer. Indeed, protection products can be up to 5-6 times more profitable than savings products.

Technology leadership

Perhaps surprisingly for a life insurer, Ping An is actually a global leader in AI, fintech and health tech. Ping An has 21,383 outstanding patent applications globally, having submitted 9,112 patent applications in 2019 alone. Ping An uses AI technology to support agent management, from recruitment to talent development through to sales support, and also applies AI extensively in the underwriting and claims assessment process. Ping An Life’s smart underwriting platform approved 96 per cent of policies for 18 million customers through automatic underwriting, with a turnaround time of 10 minutes compared to 3.8 days manually, and its AI-powered auto insurance claims platform reduced claims assessment time to 3 minutes. From our discussions with former executives of other insurers, almost all view Ping An as the undisputed technology leader in the global insurance industry.

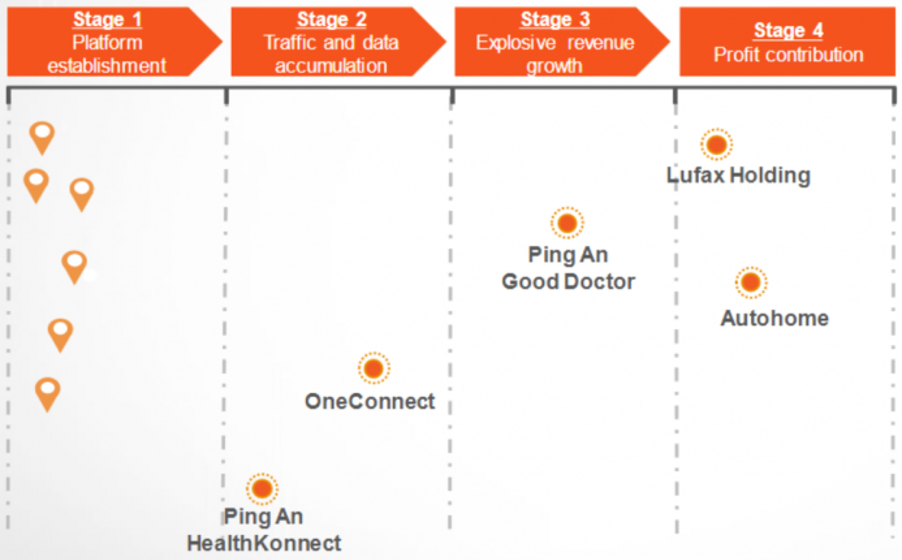

Within Ping An group, there are also numerous technology businesses at various stages of incubation and growth, spanning from online retail wealth management to financial technology-as-a-service to online health services and social health insurance management. While these do not yet contribute materially to Ping An, they are effectively free options as we do not believe investors are paying for any of these businesses.

Chart 3: Four stages of incubation of Ping An’s technology companies

Source: Company filings

Undervalued by the market

2019 was an investment year for Ping An, with significant investments made in technology across the group and in the Life agency network. This coincided with the ongoing transition of the Life business toward long-term protection products which commenced in 2018 and is expected to be completed in 2020. As a result, while Ping An’s earnings and EV grew, its market valuation did not move and in fact fell recently due to coronavirus concerns. While the coronavirus will have a negative impact on short term performance, we believe the widespread nature of the epidemic has raised awareness across the country for both protection-oriented life and health insurance and may prove to be longer term tailwinds.

At the current share price of HK$75, the entire Ping An group is being valued at just 1.1x group EV, with the Life business at an implied 1.0x EV. An EV of 1.0x implies that an insurer writes no more new business in the future and is effectively in run-off or liquidation mode. Considering Ping An Life is doubling its EV roughly every three years, we believe a market implied liquidation value for arguably the best quality Chinese life insurer is exceedingly low.

The Montgomery Global Funds and Montaka own shares in Ping An. This article was prepared 28 April with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Ping An you should seek financial advice.