Investor Insights

SHARE

Why it feels like our cost of living is rising

The Consumer Price Index (CPI) recorded no movement in the March quarter, and rose just rose 1.3 per cent in the 12 months to the March quarter 2019. So why do so many Australians feel like life is getting dearer? Research by my former colleagues at Fidelity Investments might give the answer.

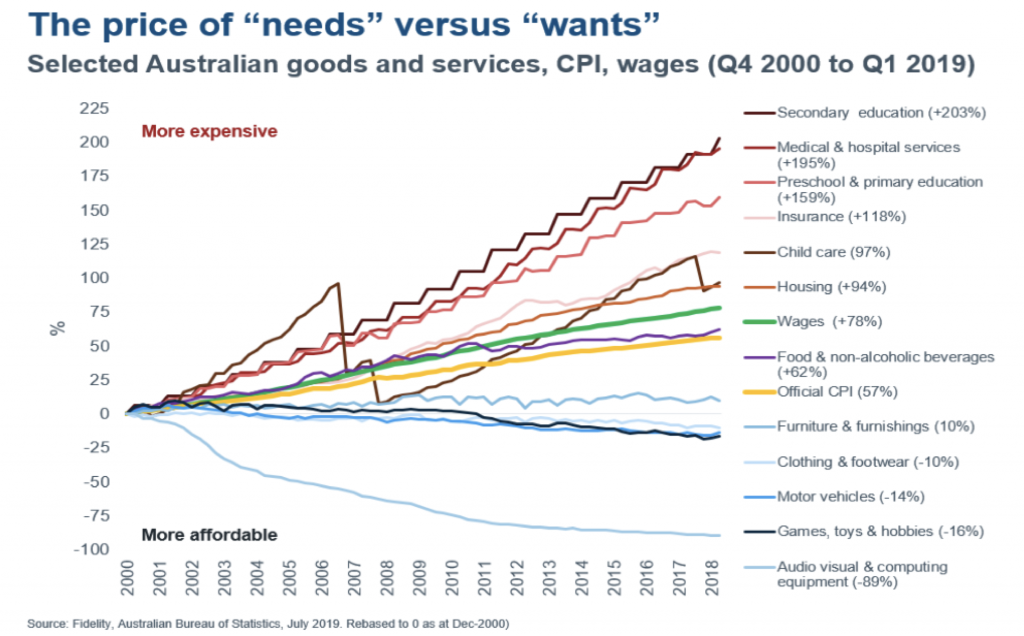

Below is a chart produced by Fidelity that shows changes to the price of “needs” and “wants” since 2000:

The chart breaks down the different components of CPI. As we can see, and should expect due to technological change etc., there is a wide discrepancy between the development of the cost over time of different goods and services.

What is quite striking though is that basically all of the categories that have experienced higher than average cost increases are of a more basic or “needs” nature, compared to the more discretionary “wants,” which have experienced much lower cost increases and even deflation over time.

Looking at the categories in the chart, I would classify secondary education, medical & hospital services, preschool and primary education, insurance, child care, housing, food and clothing and footwear as “needs” and furniture & furnishings, motor vehicles, games & toys and audio visual & computing equipment as “wants” (this will of course be different for people as some people have special needs depending on their circumstances but, on average, I think it is a pretty accurate classification).

Out of the “needs,” only clothing and footwear has seen price development under CPI and in addition, the only other category that has seen increases under wage increases is food & non-alcoholic beverages.

This is the main reason that people in general feel that the official CPI figure does understate their lived experience. You tend to notice the cost increases on more basic “needs” much more than the price deflation on your more discretionary “wants.”

What implications does this have?

My view is that this trend is unlikely to change as discretionary “wants” will most likely to continue to see price deflation caused by technological innovation driving down production costs while the “needs” are not likely to benefit to the same extent from technological innovation as they are, by their nature, more basic and people related.

With the RBA cutting interest rates to try to boost the economy and stimulate inflation, people who are living on the income from their savings rather from wage income will be further squeezed as their income will decrease while their “needs” costs are likely to go up.

This will mean that they will either need to move up the risk scale seeking higher returns (for another blog post on this theme, please see David’s recent post) or accept that they will have to consume capital at a higher pace to fund their cost of living with the increased risk of running out of savings. People may also shift some items from their ‘needs’ column to ‘wants’, for example private schooling.

I have previously written about the outlook for discretionary spending and what is happening with inflation.