Investor Insights

SHARE

Uniti Continues to Unify at an Electrifying Pace (Part 2)

Adelaide-based telecommunications company Uniti Wireless (ASX: UWL) is continuing its spending spree with additional acquisitions that has seen the market capitalisation grow from $33 million to the current $555 million. A staggering increase of $522 million in just nine-months!

In my last blog, I wrote “Forecast Revenue and EBITDA for Fiscal 2020 is $57.3 million and $16.6 million, respectively, and this places UWL on a prospective Enterprise Value to EBITDA ratio of around 21X. These numbers were calculated on the back of acquiring Fuze Net, Pivit, Fone Dynamics, Call Dynamics and LBNCo.

Fast forward a few months, and Uniti Wireless has continued its aggressive acquisition strategy with two more businesses, OPENetworks and 1300 Australia. For Fiscal 2020, management are now forecasting pro-forma Revenue and EBITDA of $80.7 million and $32.0 million, respectively, and I calculate this brings down the prospective Enterprise Value to EBITDA ratio to around 16X.

| Date of ASX announcement | Name of Acquisition | Consideration($m) | Comment | Shareprice |

| 15 April | Pivit | $0.45m | Takes combined revenue to $22m, and pro-forma F’19 EBITDA to $2m. EPS accretive of > 20 per cent on F’20 | $0.51 |

| 1 May | Fone Dynamics | $8.4m | Is forecast to be significantly EPS accretive in F’20 and beyond. Co-founder Jordon Grieves is to be appointed Head of the “Speciality Services” Division | $0.56 |

| 15 May | Call Dynamics | $2.0m | Is forecast to be materially EPS accretive in F’20 and beyond | $0.92 |

| 19 August | LBNCo | $100.0m | Forecast F’20 proforma EBITDA of $10.1m (9.9X EBITDA). Takes combined F’20 pro-forma EBITDA to $16.4m | $1.42 |

| 11 October | OPENetworks | $27.5m | Forecast F’20 EBITDA of $2.5m (11.0X EBITDA), and expected F’21 EBITDA of $4.5m (6.1X EBITDA). Forecast to be > 10 per cent EPS accretive. | $1.41 |

| 3 December | 1300 Australia | $78.0m | Forecast F’20 EBITDA of $12m (6.5X EBITDA). Should deliver, on a proforma basis, 28 per cent EBITDA per share accretion in F’20. Takes UWL’s combined proforma revenues to $81m and EBITDA to $32m, inclusive of certain cost savings on acquisition (EBITDA margin of 40 per cent). | $1.62 |

| TOTAL SPEND | $216.35m |

The big question a forensic accountant may ask is, “how does a company that has spent $216 million in the past nine months have an increased market valuation of $522 million?” Net of cash on hand, we have calculated the uplift of this “roll-up effect” to approximate 220 per cent.

A breakdown of the contributions for the proforma FY20 Revenue, EBITDA and EBITDA margins follows:

| Business | Revenue ($m) | EBITDA ($m) | EBITDA Margin (%) |

| Uniti | 35.3 | 6.5 | 18 |

| LBNCo | 22.1 | 11.0 | 50 |

| OPENetworks | 4.4 | 2.5 | 57 |

| 1300 Australia | 18.9 | 12.0 | 63 |

| Total | 80.7 | 32.0 | 40 |

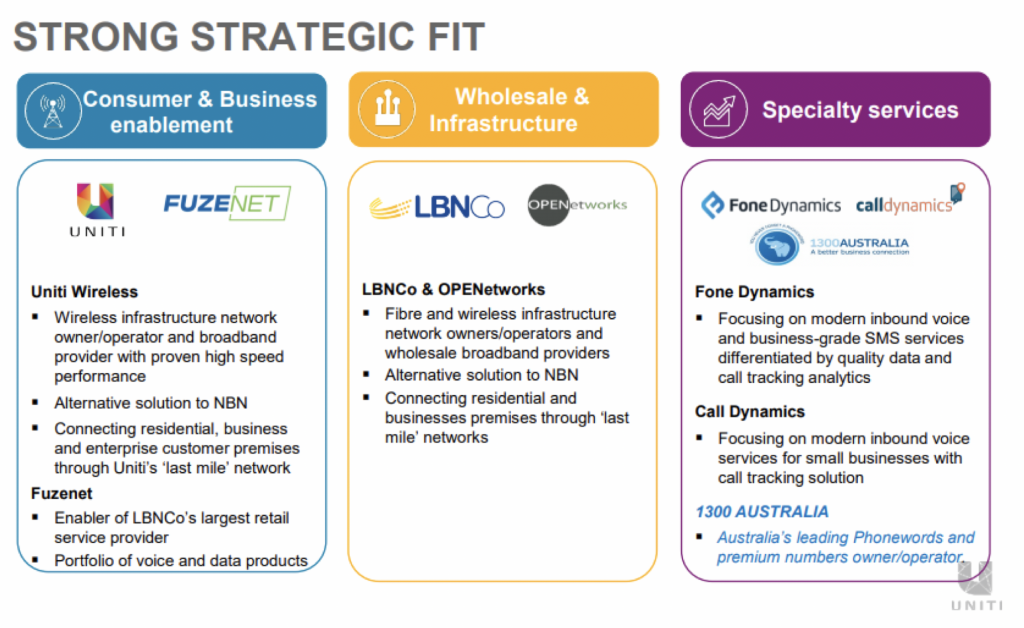

In terms of Divisional breakdown, management have said Consumer and Business enablement, Wholesale and Infrastructure and Speciality Services account for 34 per cent, 28 per cent and 38 per cent, respectively of the pro-forma 2020 Revenue. The structure of the three Divisions are below:

So, what is the roll-up effect?

So, what is the roll-up effect?

Let’s assume a company such as Uniti Wireless takes its annual EBITDA up from $2 million to $32 million, purely via acquisitions costing a total of $216 million. That is the additional $30 million of EBITDA were acquired on an average EBITDA multiple of 7.2X. However, if the underlying equity in that company is now being valued on 16X EBITDA, then every $1 million of additional EBITDA acquired has a 2.2X or 220 per cent uplift (16.0X/7.2X).

We saw this play out in many industries in Australia, particularly in the 1980s, as several businesses were consolidated usually forming a “happy oligopoly.”

Michael Simmons (CEO) and Vaughan Bowen (Executive Director) are certainly getting many of the M2 Telecommunications band back together, with Darryl Inns (appointed CFO in April) recently being joined by Kurt Wagner (Head of Consumer Business Enablement) and Ashe-Lee Jegathesan (COO) and they now account for five of the company’s top seven executives.

After an extraordinarily busy and successful 2019, the team at Uniti Wireless have had a wonderful start in terms of executing their second Telecommunications “roll-up.”

The Montgomery Small Companies Fund own shares in Uniti Wireless. This article was prepared 09 December with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Uniti Wireless you should seek financial advice.

* Please click here to read my last blog on Uniti Wireless.

Investors who subscribe to the Montgomery Small Companies Fund prior to 13 December 2019 will receive a 0.25% management fee rebate quarterly. This discount will take the form of additional units in the fund and will apply until 31 December 2021. To download the Product Disclosure Statement for the Montgomery Small Companies Fund, please click here.