Investor Insights

SHARE

The growth v value conundrum

Since the market bottom of the Global Financial Crisis in March 2009, the Russell 1000 Growth Index (R1G) has outperformed the Russell 1000 Value Index (R1V) by over 300 per cent cumulatively. Many investors seem fearful that this current era of growth style dominance will end with the same thud as its predecessor, when the Nasdaq Composite stock market index, after appreciating by 400 per cent from 1995, proceeded to decline by 78 per cent from its peak in March 2000 to October 2002.

The cumulative out-performance of the R1G v the R1V during the eleven years from 2008-2019 has been roughly the same as in the period from 1988-1999. And that out-performance has been further accentuated so far in 2020.

Despite the appearance of style déjà vu, this current cycle of growth outperforming value appears to be different for the following three reasons.

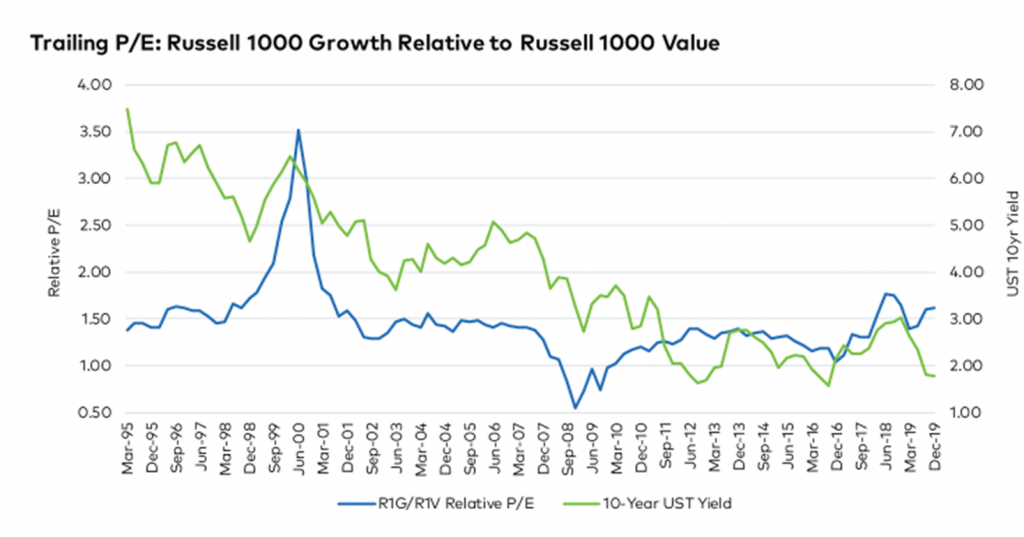

- Current P/E levels relative to the late 1990s, combined with a record low interest rate environment, indicates that earnings growth has been a more significant driver of the recent outperformance. That is the relative PE of R1G/R1V peaked at 3.5X in early 2000, a level well above the current level. Second, the yield for US ten treasury bonds have declined over the twenty years under review from around 6.5 per cent to the current 0.7 per cent, generally justifying higher growth equity valuations.

- The top contributors to the R1G’s performance saw far more economic value accrue to their businesses relative to their R1V counterparts. Some research, for example, has indicated the ten largest contributors to the R1G’s performance over the past five years has generated $500 billion or over 2.5X more in revenue than the ten largest contributors to the R1V’s performance (and logically at much higher profit margins). It seems the 1995-2000 growth v value cycle was a far more valuation driven period than today. By early 2000, the technology, media and telecom boom had transformed into a valuation driven boom, where the number of eye-balls on a particular company’s books had become a valuation feature.

- The full promise of the internet boom is now being understood and the advent of COVID-19 has accelerated the development of many growth companies’ business models. Enormous structural trends around the digitisation of the global economy seem to have a long runway. Maybe in early 2000, the stock-market was simply too far ahead of the actual business models. The enormous improvement in computing power, storage, mobile penetration and data speeds has meant the required infrastructure is now in place.

Note: The Price/ Book Ratio is one of the key metrics that Russell uses to define their growth and value style indices. However, this ratio surely becomes less relevant in the digital age, where businesses become more reliant on intangible assets.

Despite the appearance of style déjà vu, this current cycle of growth outperforming value appears to be different than the past. Read David Buckland's three reasons for the difference. Click To Tweet