Investor Insights

SHARE

New data confirms the meteoric rise of online shopping

The government-imposed COVID-19 lockdown accelerated a number of social trends. One of those was our increasing preference for online shopping. Recent data shows that even though the lockdown pushed total retail sales off a cliff in April, online sales shot up. And one retailer – Kogan – stood out from the pack.

One of the more surprising performances within the market this year has been the retailer. According to the ASX 300 Retail Accumulation Index, this group of 14 discretionary retailers has been one of the best performing sector indices in the Australian market, falling just 0.7 per cent this calendar year. This compares to the broader market fall of 9.1 per cent, as measured by the ASX 300 Accumulation Index.

Given the direct impact of the lockdowns on retailers and their high degree of fixed cost leverage, this might appear to be aberrant. The recently released final retail sales data for April reveals that retail sales exhibit a steep decline in overall spending in April even as the country went into lockdown.

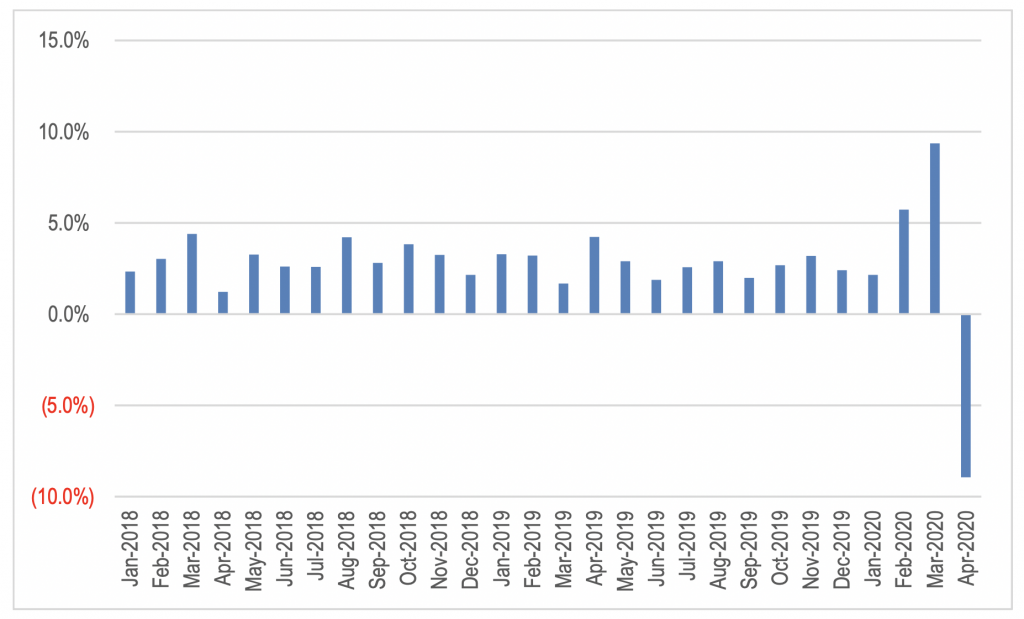

Figure 1: % Change in Total Australian Retail Sales YoY – Original Data

Source: ABS

When we calculate the growth over the 4 months to the end of April relative to the prior year (which matches up with the 2H20 reporting period for most listed retailers), overall retail sales were still higher by 2.1 per cent.

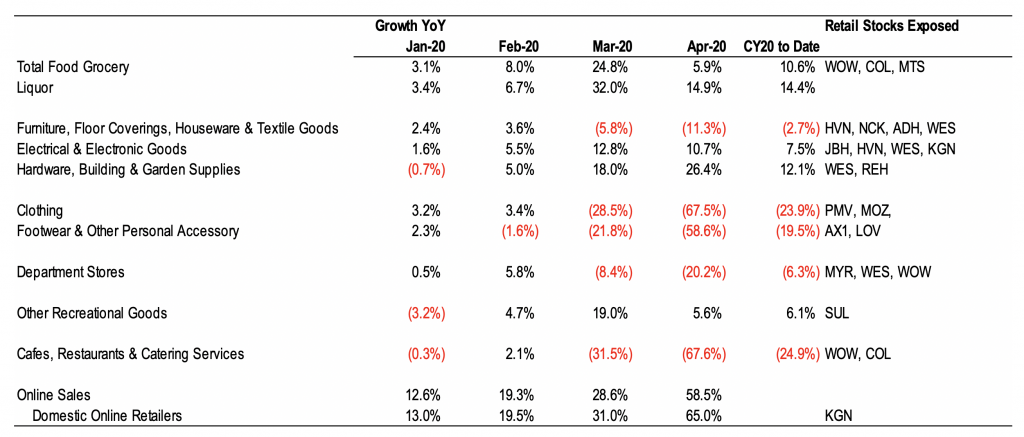

Not all categories have performed uniformly. The table below shows the rate of growth in retail sales (by category) for each month this year, along with the cumulative rate of growth in CY20 to date, and listed companies that are exposed to each category.

Table 1: Monthly Change in Retail Sales by Category – Original Data

Source: ABS, NAB

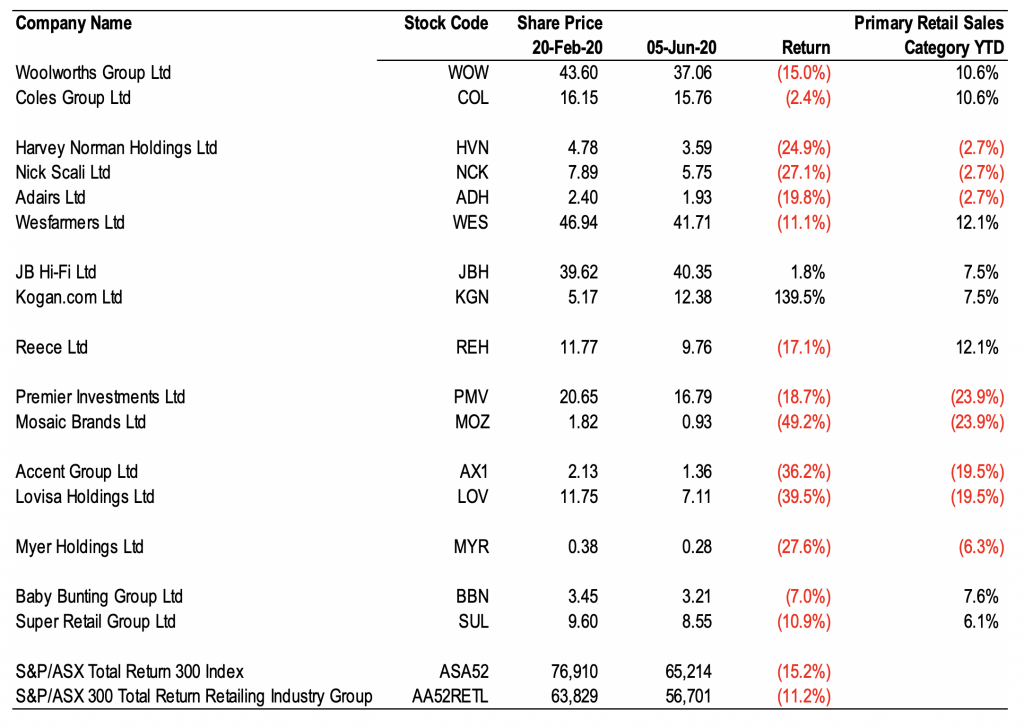

If this data is lined up with the performance of the individual stocks since the market peaked on 20 February 2020, Kogan and JB HiFi are the only retailers from this list which have generated positive returns over that period.

Table 2: Listed Stock Performance Since the Market Peak

Source: Bloomberg

Relative to the broader market, 7 of 16 stocks have outperformed the broader market since the peak. This is a surprising outcome given the operating leverage and the likely losses generated by retailers during the lockdown period will have the enterprise value of these business shift from equity toward debt. Even if the retailing operations are worth the same amount as they were prior to COVID-19 lockdowns, the increase in debt caused by cash outflows during this period means the equity has had a permanent reduction in value. In the case of those companies that have raised fresh equity, the increase in debt has been mitigated. However, the increase in share count reduces the value of the equity per share.

Wesfarmers has released a very strong trading update with both Bunnings and Officeworks delivering extremely strong sales growth for the 5 months to May. These formats have benefited from their classification as essential, enabling the stores to remain open through the lockdown and the jump in growth in the DIY and home entertainment markets on the back of the increased time spent at home. This is reflected in the strength of the ABS retail sales data for the Hardware, Building & Garden and the Electrical & Electronic Goods categories.

Wesfarmers has benefited from its strong positioning in online retailing across its formats together with their timely acquisition of Catch.com.au last year. Wesfarmers also noted that apparel sales at Kmart and Target have improved materially in the last few weeks due to cooling weather and increased mall traffic.

The data shows that individual segments of the retailing market are performing differently resulting in individual retail stocks experiencing differing conditions and positioning.