Investor Insights

SHARE

Checking in with our global portfolios amid COVID-19

We have naturally received a number of questions about how we are framing the risks around the coronavirus and how we are positioning our global portfolios. What follows is a brief summary of our thoughts on these topics, as they currently stand.

Framing the coronavirus challenge

This is a contagious virus with a death rate higher than the regular flu – particularly for older people. While the spread of this virus appears to be under control in China and South Korea, it is far from under control in Europe, the United States and elsewhere, including here in Australia. Like others have forecast, we expect the number of global cases to increase substantially from current levels. And to the extent other countries follow the Italian model of a country-wide quarantine, global demand and supply chains may well be impacted even more severely than we have seen to date.

Stock market reaction

Over the last three weeks, the S&P500 equity index has fallen by 19 per cent. This has been a particularly sharp selloff and is naturally causing a lot of fear and anxiety out there amongst investors.

Our current portfolio positioning

Today, we are positioned as follows:

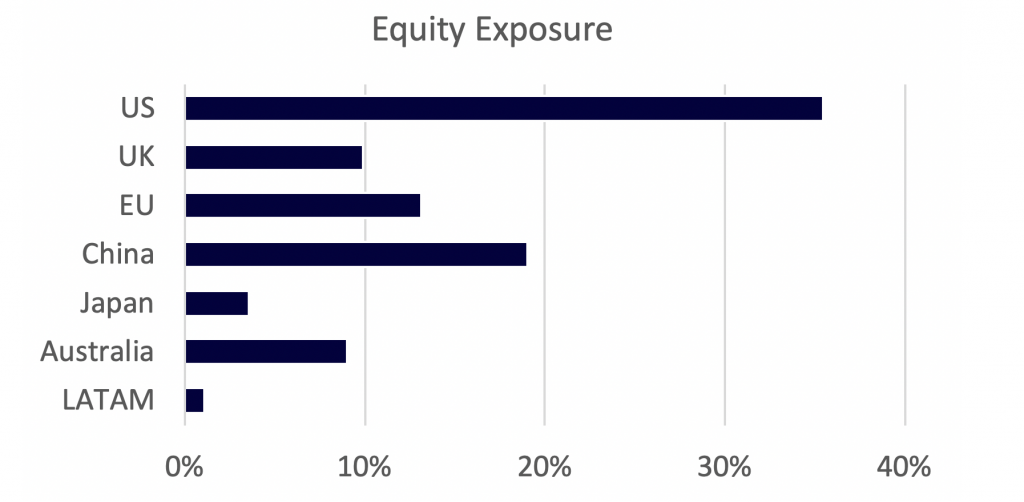

- In our Montgomery Global Fund and ASX-quoted ETMF “MOGL” we are carrying 8-9 per cent in cash. In terms of our equity exposures on a true look-through earnings basis, the following chart depicts the regions to which our portfolio companies are exposed.

- In our Montaka variable-net strategy, we are 64 per cent net long. Our long portfolio in this strategy is substantially the same as the portfolio in our global long-only equity offerings, described above. In our short portfolio, we are exposed to a number of businesses which are facing particular coronavirus-related challenges. These include:

- A Hong-Kong based airline;

- Two cruise ship owners;

- Two regional casino (slot machine) owners and operators in the US;

- An Italian football club;

- A US auto manufacturer;

- A gym and fitness business in the US;

- An international hotel group; and

- A US restaurant chain.

Understanding the businesses we own

The stock prices of many of the businesses we own are down since the beginning of the year. As an investor, the challenge one faces on any given day is working out whether the stock price observed is at, above, or below the true intrinsic value of the underlying business. Today is no different.

The coronavirus has impaired business values for sure. But by how much? Many are forecasting that the coronavirus challenge and its global impact will get worse before it gets better. This seems like a reasonable view. But the stock prices of many businesses are down by so much that it may well be the case that stocks are implying a far worse and protracted economic situation than what will ultimately play out. If true, then these stocks would be undervalued.

Here are a few observations:

- The yields on the 10-year government bonds in the US and Australia today are 0.87 per cent p.a. and 0.78 per cent p.a. respectively. One can think of these bond yields a bit like a P/E ratio of 115x and nearly 130x respectively, for a cash flow stream that is not growing.

- Against this backdrop, the shareholder equity in Alphabet (NASDAQ: GOOGL) today trades on a forward P/E multiple of 19.6x for an earnings stream that will grow for decades to come.

- Or consider that Airbus (Euronext: AIR) has experienced a €42 billion decline in value in just the last month or so. Unless one believes that humans will altogether stop flying indefinitely, it is difficult to make sense of such a decline in market value – especially when the intrinsic value of this business is driven, not by orders it receives today, but by deliveries of aircraft for decades to come.

Across the board, we believe we have now entered into a period in which undervalued businesses are becoming more and more undervalued.

Prospects for the future

As we write this today, the equation for the businesses we own is as follows: (i) the stock prices of many of our owned businesses (and other businesses we would like to own) are down significantly and below our internal assessment of intrinsic value; (ii) global monetary stimulus has commenced and, we believe, will intensify over the coming days and weeks; and (iii) global fiscal policies will follow in a significant way for the first time since the Global Financial Crisis (GFC) in 2008. (Australia has just announced one, for example).

As tragic as this coronavirus is, it too will pass. And when it does, the combination of (i) significant stock undervaluation; plus (ii) significant global monetary stimulus; plus (iii) significant global fiscal stimulus will likely result in a powerful re-rating in equities. We fully intend to be well-positioned for this period, irrespective of how difficult the next few weeks and months may be.

Finally, we would encourage investors to think deeply about their time horizon for investment. Remember, following the GFC lows in March 2009, it took only five years for the S&P500 to triple in value.

Over the coming weeks and months, expect us to be buyers of undervalued, high-quality businesses, not sellers.