Investor Insights

SHARE

Active management and the paradox of skill

In the world of active equity management, investment managers – ourselves included – seek to “outperform” the broader equity market index. This outperformance is typically referred to as “alpha” in the industry jargon. Of course, alpha can be both positive – when a manager outperforms; and negative – when a manager underperforms.

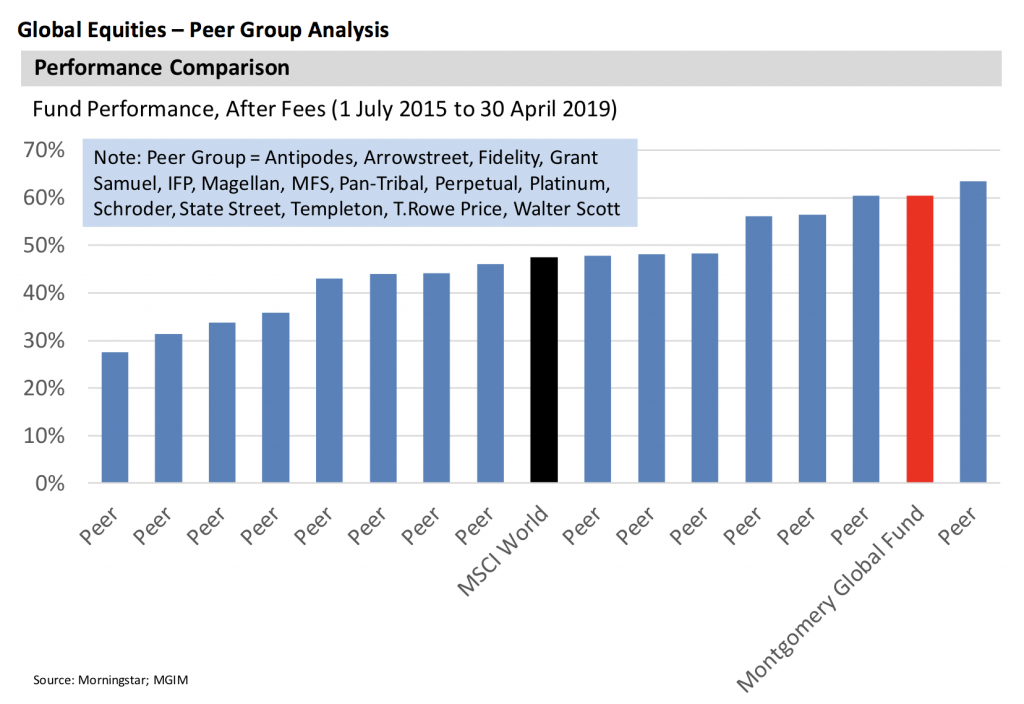

One thing to keep in mind about active management is that, by definition, the generation of alpha is a zero-sum game. That is, one manager can generate alpha if, and only if, there are other managers out there generating negative alpha. The returns of the global equity peer set below appear to be roughly consistent with this concept: over the last (nearly) four years, approximately half the major global equity managers in Australia outperformed the global equity market; while approximately half underperformed.

Enter the “paradox of skill”. This paradox states that in activities (such as active equity investing) where both skill and luck contribute to outcomes, luck will play a larger role in determining results as skill levels increase.

Have you noticed that, over shorter periods of time, the alpha generation of even skilled investment managers appears somewhat random? This is not because investment managers are not as good as they used to be – indeed, it’s the opposite. The skill level of investors today has increased so much that equity prices do a better job of reflecting relevant information – though mispricings do still emerge from time to time.

If you would like to learn more about the interaction between skill and luck, I would recommend a book written by your author’s former Professor at Columbia University, Michael Mauboussin, called The Success Equation. In addition, Annie Duke’s Thinking in Bets is another must-read to think about decision making in the context of imperfect information combined with luck.